As it turns out, Ontario’s booming real estate market wasn’t booming because ordinary Canadians desperately wanted to buy a home; rather, market speculators took advantage of ultra-low interest rates to buy up condo properties in hopes of turning a generous profit.

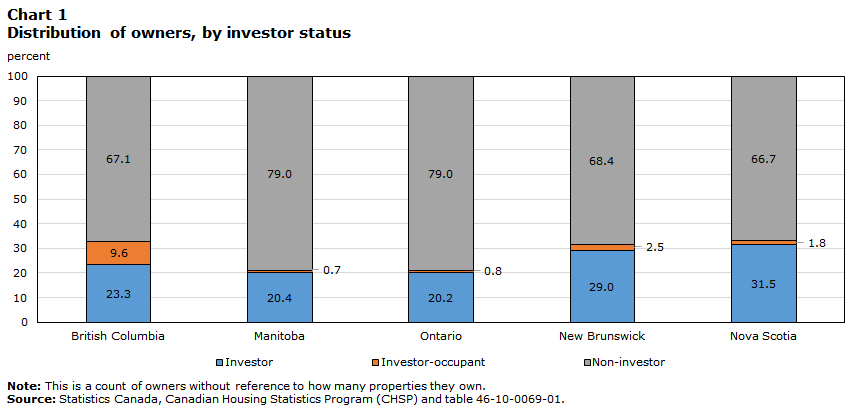

Canada’s housing market isn’t for ordinary Canadians looking for their first home anymore: instead, it’s becoming a commodity where speculators search for their next investment. A recent analysis by Statistics Canada’s Canadian Housing Statistics Program (CHSP) found that at the beginning of 2020, more than one out of five homeowners bought the respective property for investment purposes.

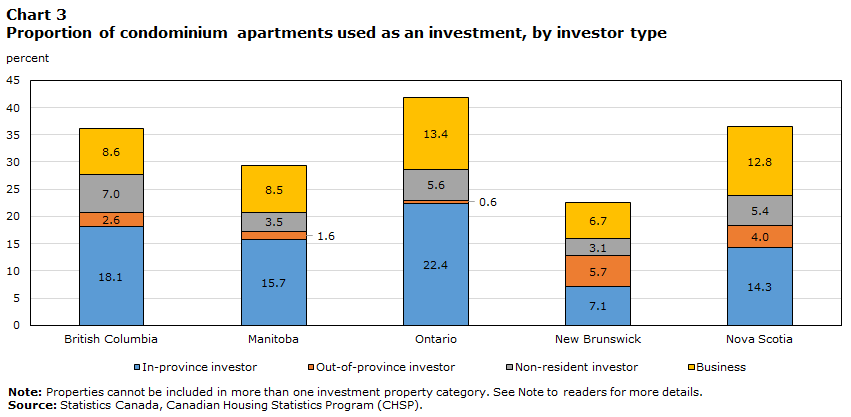

The finding coincides with the Bank of Canada’s analysis indicating that the trend was only exasperated during the pandemic; the central bank’s analysts noted there has been a substantial increase in the proportion of property acquisitions by investors in the first half of 2021. Using data from Nova Scotia, New Brunswick, Ontario, Manitoba and British Columbia, the CHSP’s research found that Canada’s condo market was the most attractive commodity for investors, whereby they owned approximately half of all condo units built between 2016 and 2020.

In Ontario a staggering 41.9% of condos were designated as investment properties, while in British Columbia that share amounted to 36.2%. In fact, the majority of investment properties in Ontario were purchased by businesses— a total of 74,485 units, or 13.4% of dwellings in this category— to be exact, marking the highest proportion among all provinces analyzed. Foreign investors owned about 5.6% of the condos in Ontario, and 7% in British Columbia.

Meanwhile, the CMAs of Toronto and Vancouver— both of which have dominated headlines for out-of-control real estate prices over the past two years— were also very attractive for investors. The CHSP concluded that a total of 21.3% of condos and homes were used as an investment, while the same share in Toronto stood at 16.3%.

According to the CMHC, condos make up about one-fifth of the nation’s purpose-built housing units, with the housing agency repeatedly asserting the important role investors play in increasing rental supply. However, according to Simon Fraser University’s city program director Andy Yan, the commodification of Canada’s real estate market could squeeze out ordinary Canadians wanting to own a roof over their head.

“We talk about building more but building more for whom. Are you building for people looking for their first home or are you building for people looking for their next investment,” he said, as cited by The Globe and Mail.

Information for this briefing was found via Statistics Canada, The Globe and Mail, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.