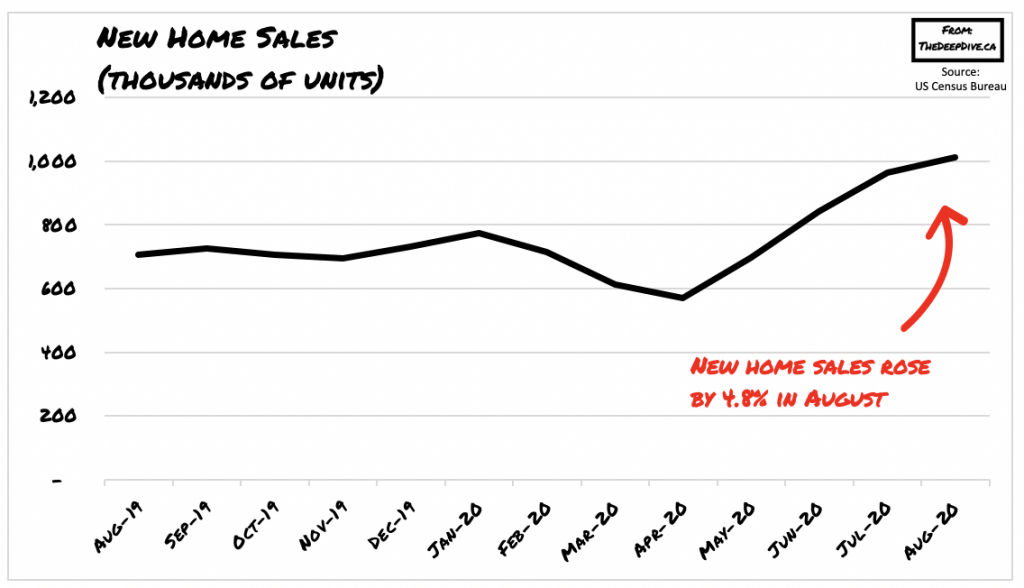

As more and more Americans revert to the stay-at-home status quo that has plagued the country since the onset of the pandemic, the demand for housing has skyrocketed to record-breaking levels. According to the US Census Bureau, newly-built home sales rose by 4.8% on a month-over-month basis – the largest increase in over 14 years. However, as the number of home sales continue to beat analysts’ expectations, the demand for housing is alarmingly beginning to outpace supply.

When the housing market is at an equilibrium, a 6-months worth of supply is considered an adequate balance; however, the sales pace for the month of August saw builders’ supply fall to a mere 3.3 months, signaling that the situation is about to get significantly more heated. Given that housing demand tends to be robust while supply is not, the impending affordability of homeownership is going to be negatively impacted.

Although the pandemic has spurred a tremendous demand for home buying, the opposite has occurred for potential sellers. According to realtor.com, there are 400,000 fewer homes on the market since the beginning of the pandemic, as many Americans were concerned about social distancing restrictions and increasing infection rates. Moreover, it is also worth noting that when a seller lists their home on the market, they inadvertently also typically become a buyer in the process, given that they too are now looking for another home.

As such, housing starts have not been able to keep up with the accelerating demand, and are only 1% above last year’s levels. During March and April, many home builders had to temporarily shut down operations; however, as pent-up demand was soon released into the market once restrictions were lifted, many builders have yet to catch up. In fact, some of those homebuilders have actually slowed down construction in the wake of recent soaring lumber prices. Nonetheless, as the pandemic continues to advance into a potential third wave, the number of Americans entering the first-time home buyer market will continue to increase.

Information for this briefing was found via the National Association of Realtors and realtor.com. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.