In further testament that the labour market is rapidly losing momentum despite assurances from the Fed and the Biden administration otherwise, the ADP’s latest private payrolls fell short of expectations, seeding fears of a forthcoming economic slowdown riddled with inflation.

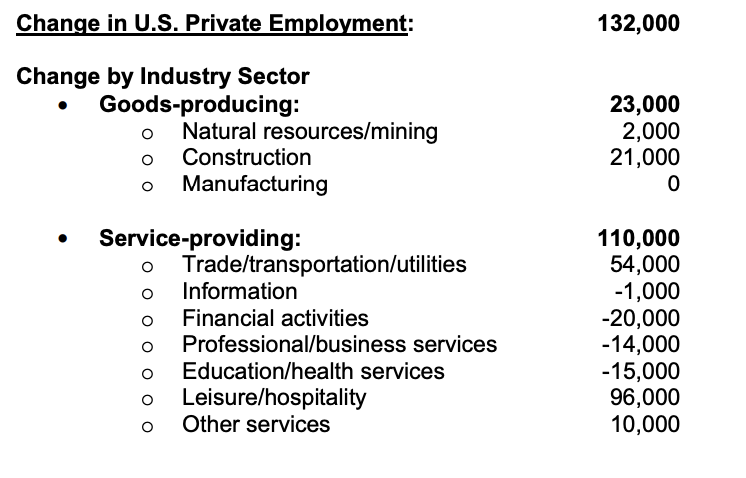

Private payrolls rose by a paltry 132,000 in August, marking the second consecutive slowdown in gains, and a substantial decline from the 268,000 reported the month earlier, even following a revised methodology that includes both workers’ jobs and wages. Much of the job gains were concentrated across services industries, which added about 110,000 new positions, while the leisure and hospitality sector grew by 96,000. With respect to business size, companies with over 500 employees added 54,000 positions, medium-sized firms added 53,000, while companies with less than 50 employees only contributed 25,000 to August’s gain.

“Our data suggests a shift toward a more conservative pace of hiring, possibly as companies try to decipher the economy’s conflicting signals,” said ADP chief economist Nela Richardson. “We could be at an inflection point, from super-charged job gains to something more normal.”

ADP, which compiles private payrolls data and accounts for employees actively working unlike the BLS report which only includes individuals that received pay that month, revised its approach to estimating the jobs total. “As the labor market evolves, methods for measuring employment dynamics also need to evolve,” Richardson said. “Combining job and pay data in one report, coupled with high-frequency releases, will give us a clearer picture of the labor market.”

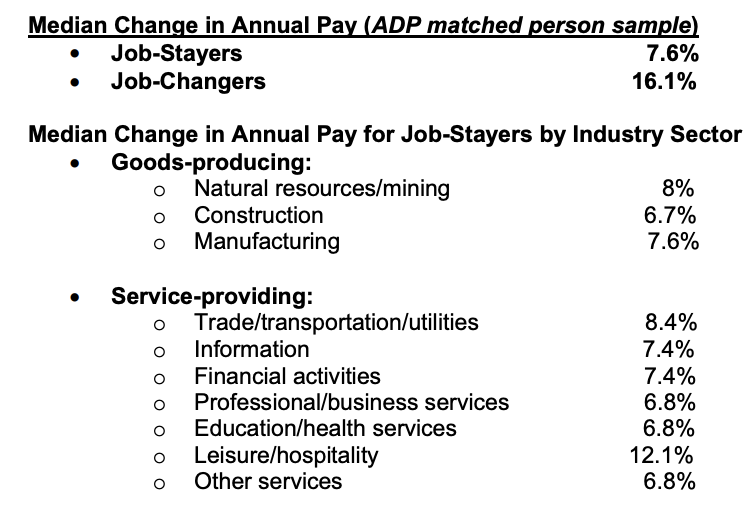

In addition to a new partnership with the Stanford Digital Economy Lab, the payroll processing company will now include data on wage figures. The month of August saw annual pay increase 7.6% further fuelling concerns that inflation is becoming even more imbedded in the US economy, particularly during a time of negative growth in the second quarter of 2022.

Time to go back to the drawing board?

Information for this briefing was found via ADP. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.