US producers once again paid higher prices for goods in October, as inflationary pressures turn out to be a lot more persist than policy makers and economists contended.

According to latest figures published by the Bureau of Labour Statistics on Tuesday, the producer price index accelerated 0.6% last month, marking a gain of 8.6% from October 2020— the sharpest annual increase since 2010. Core PPI, which does not account for volatile components such as food and energy, rose 0.4% month-over-month and 6.8% from one year ago.

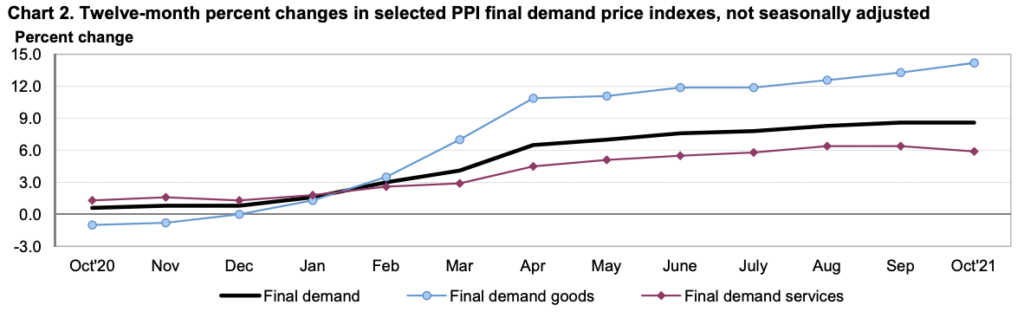

Over 60% of last month’s PPI increase was the result of higher goods prices, which advanced 1.2% amid higher energy costs. The cost of services also rose in October, albeit at a modest 0.2% for the second consecutive month. The index for energy prices jumped by the most since March, while food prices pared back gains for the first time in three months, largely due to a 10.3% decline in veal and beef prices.

The latest figures further attest to the effect that ongoing supply chain bottlenecks and transportation disruptions have on final prices for goods and services. With rapidly accelerating input costs, producers will be looking to pass the growing burden onto consumers in the form of higher prices, sending inflation even hotter. A number of major companies, including 3M Co.m Stanley Black & Decker Inc., and Masco Corp. have all signalled they will be tacking the added costs onto the final price of their products.

Indeed, the sharp increase in price pressures has created a significant headache for the Federal Reserve, which just last week finally decided to taper its monthly asset purchases. Fed Chair Jerome Powell did acknowledge that inflation has run a lot higher and longer than previously anticipated, but said that the labour market still hasn’t reached “substantial further progress.”

Information for this briefing was found via the BLS. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.