US producer prices eased in October by more than market expectations, suggesting that inflationary pressures are finally starting to abate thanks to the Fed’s aggressive tightening cycle.

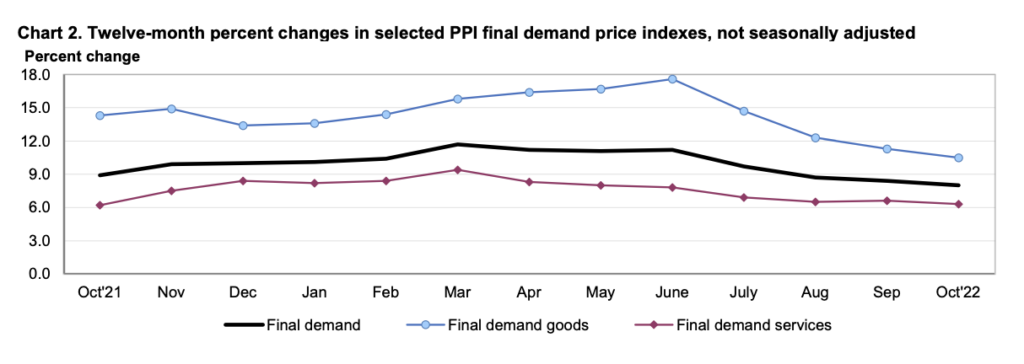

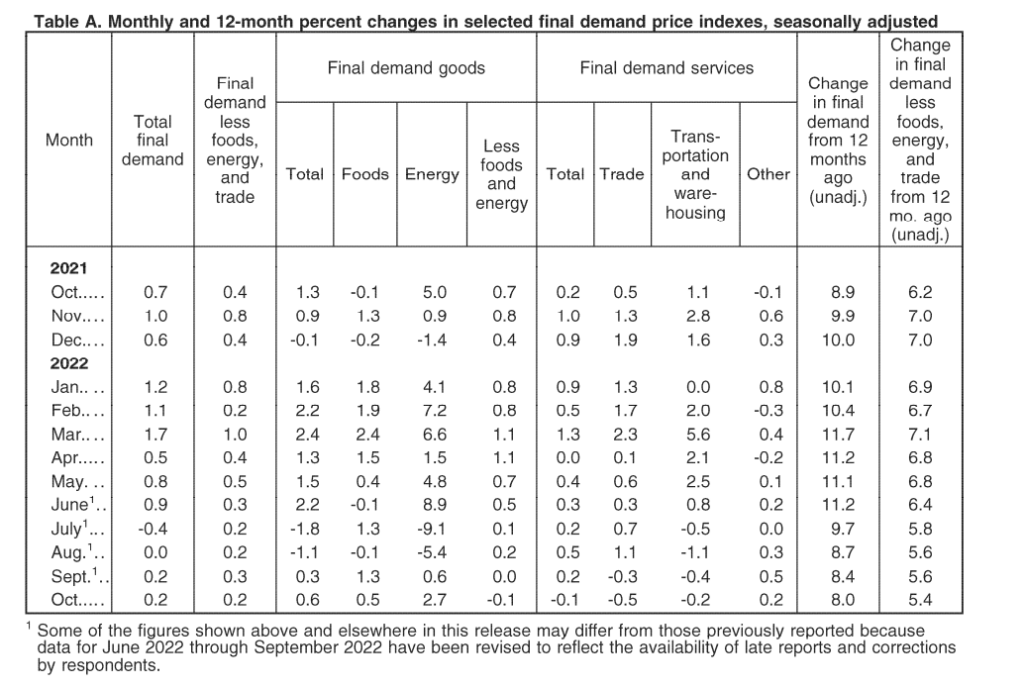

The producer price index for final demand rose 0.2% from September and 8% from October 2021, marking the smallest year-over-year gain in over 12 months. Economists polled by Bloomberg forecast a 0.4% monthly gain and an 8.3% advance from one year ago. Meanwhile, core PPI, which does not account for food and energy categories, remained unchanged last month, rising 6.7% annually.

According to the BLS report, goods prices jumped 0.6% largely due to a rise in food and energy prices, which rose 2.7% and 0.5%, respectively. On the other hand, prices for final demand excluding food and energy dropped 0.1%. In fact, over 60% of last month’s final demand goods increase was attributed to the gasoline index, which advanced 5.7%. However, what was most pivotal about last month’s print was the unexpected drop in final demand services, which slumped 0.1%— the first decrease since November 2020.

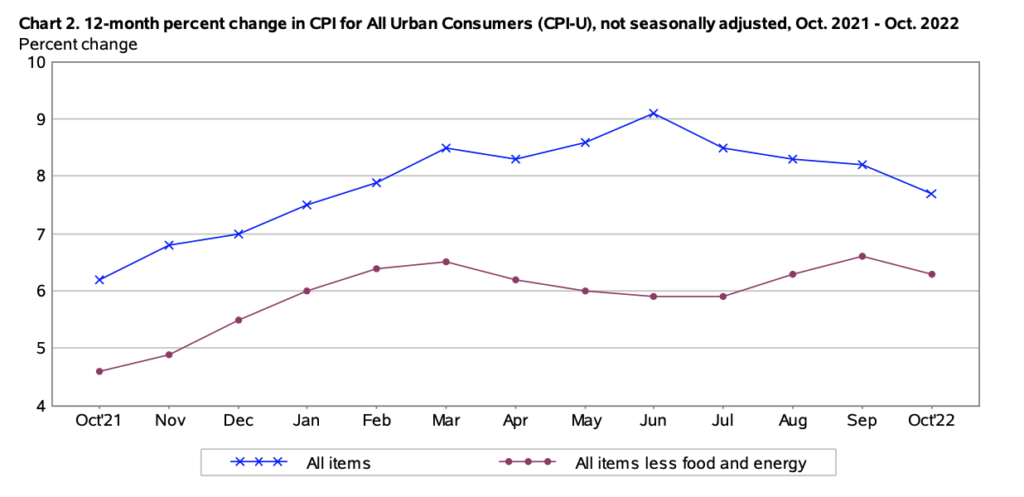

The latest data follows last week’s closely-watched CPI print, which showed consumer prices increase 7.7% over the past 12 months, signalling that the sharpest acceleration in inflation over the past 40 years is finally beginning to wane.

Information for this briefing was found via the BLS. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.