Americans are beginning to curb their spending as out-of-control inflation increasingly erodes away at their purchasing power.

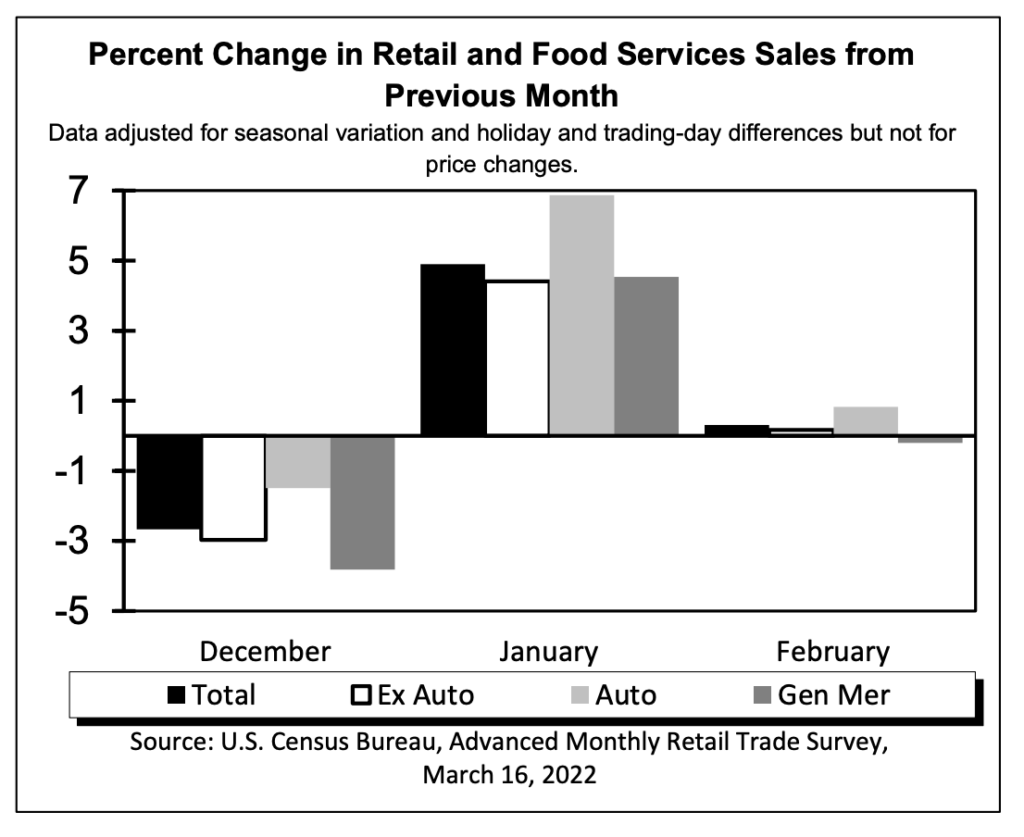

Fresh data released by the Commerce Department on Wednesday showed that retail sales only grew 0.3% in February, down from a revised gain of 4.9% in the month prior. The majority of the increase was due to a jump in spending on gasoline, which rose 5.3%; excluding sales at gasoline stations though, retail sales were down 0.2% last month.

February’s retail sales figures came short of forecasts from economists polled by Bloomberg, who called for an increase of 0.4% month-over-month. Out of the 13 retail categories, seven of them reported growth, including gas stations, restaurants and bars, hobby stores, and motor vehicle dealers. “The sales roller coaster between October and February reflected an atypical seasonal pattern through the holidays that pushed sales forward and backward out of December, and an omicron headwind in December and January,” said economists from Action Economics LLC, as cited by Bloomberg.

The latest figures come the day of the Federal Reserve’s highly awaited decision on interest rates, which are expected to increase for the first time in four years in response to the hottest inflation in 40 years. However, the increase in borrowing costs may also stifle economic growth, as the narrow spread between the 2-year Treasury yield and the 10-year Treasury indicates a recession may be pending.

Information for this briefing was found via the Commerce Department. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.