When the severity of the coronavirus pandemic became evident and countries around the world began to impose infection-mitigating restrictions, the demand for crude oil collapsed. This undesirable effect ultimately impacted the US shale industry, which was already hanging on its last threads due to lack of revenue to fund growing debt loads,

With demand during the pandemic at an all-time low, April’s oil futures experienced a rare occurrence of venturing into negative territory. Although oil has since rebounded to approximately $35 per barrel, the price of oil still remains 40% lower this year. As a result, US shale producers are facing a very uphill battle, and explorers have decided to continue reducing drilling activities in the biggest shale patch in the world.

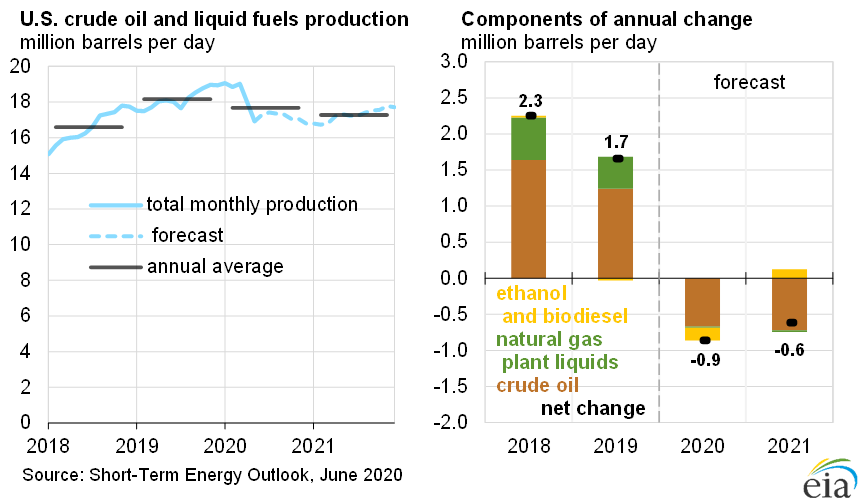

The Permian Basin of West Texas and New Mexico was the subject of a reduction in active drilling rigs, which decreased by another 4 more rigs to only 137 remaining – the lowest since 2016, according to data compiled by Baker Hughes. Going forward, US shale explorers are implementing significant measures to curtail spending and remain conservative during the pandemic. Since March, US oil production has fallen by 15%, to 11.1 million barrels per day, according to Energy Information Administration.

Information for this briefing was found via Bloomberg and Energy Information Administration. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.