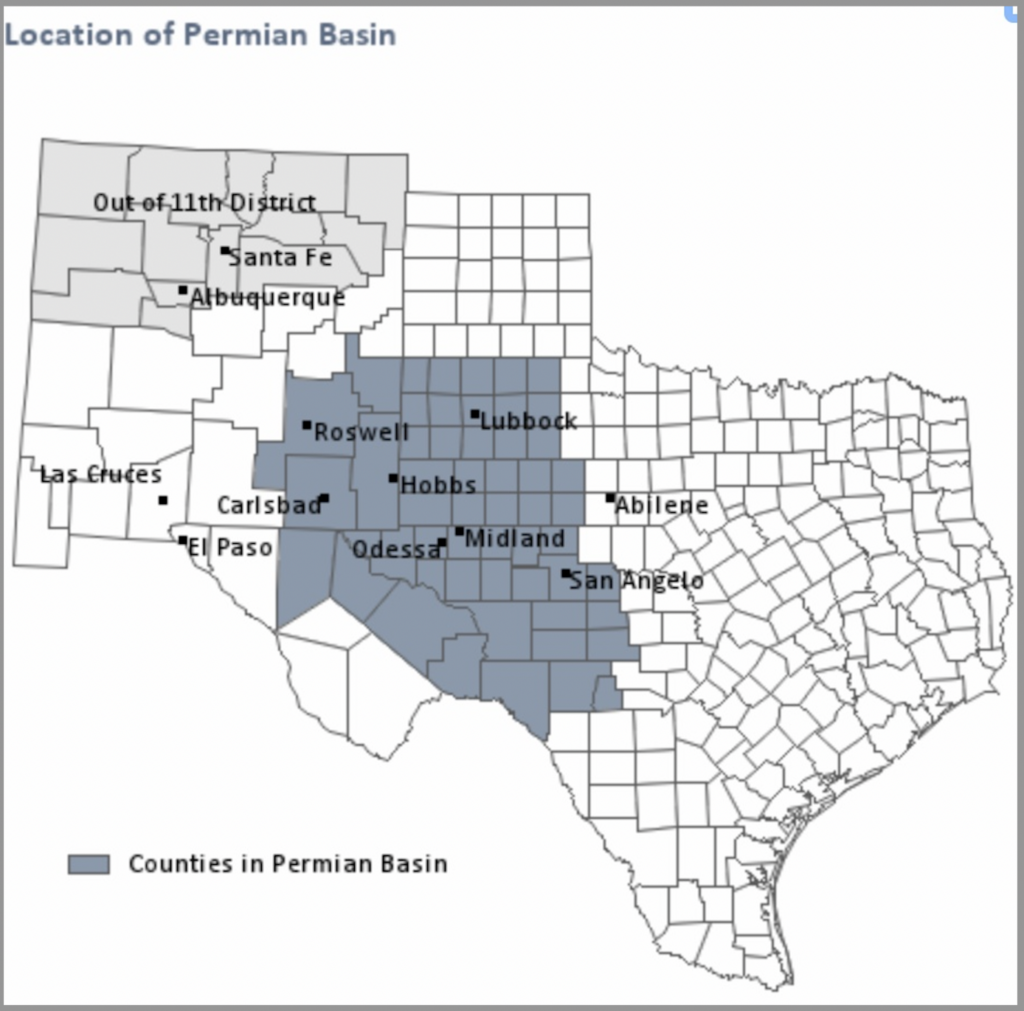

Recent heightened seismic activity in the Permian Basin gas producing region could have far-reaching implications for natural gas prices.

Two recent earthquakes in regions of the Permian Basin in west Texas where hydraulic fracturing, also known as fracking, drilling methods are used to produce natural gas and oil could have far-reaching implications for North America’s oil and gas industry. On December 16, a 5.4-magnitude tremor hit near Midland, Texas (population of about 130,000). This followed a November 18 quake of the same magnitude in a less populous area near the border of Reeves and Culberson counties.

The December and November tremors represent the third largest quakes in Texas history and the largest ones recorded since 1995. The number of earthquakes has spiked in recent years in the Permian Basin, but those quakes have generally had Richter scale readings in the two to three range. These recent quakes were much more powerful. The Richter scale measures the amplitude of seismic waves and is expressed on a logarithmic scale, so a 5.0 quake is about 100 times stronger than a 3.0 reading.

In a fracking operation, pressurized water, chemicals and sand are injected into shale deposits to release the gas and oil trapped within the rock. Scientists generally theorize this injection procedure is not the chief reason for increased seismic activity. Instead, many believe the disposal of contaminated, salty water deep underground, a common practice at the end of the fracking process, can awaken dormant fault lines.

A fear for proponents of fracking is that one or more additional large earthquakes centered near Permian Basin fracking operations could occur (in reasonably well populated areas). If so, serious investigations of what aspect of fracking is causing these seismic events will probably take place. A determination that the pressurized injection of water and chemicals, as opposed to their disposal, would be troubling and could cause government officials to consider whether the positive economics of fracking can offset the risk of seismic activity.

Politicians and regulators in a pro-drilling state like Texas would of course be disinclined to make such a judgment, but further significant earthquake activity could force even those leaders to make tough choices.

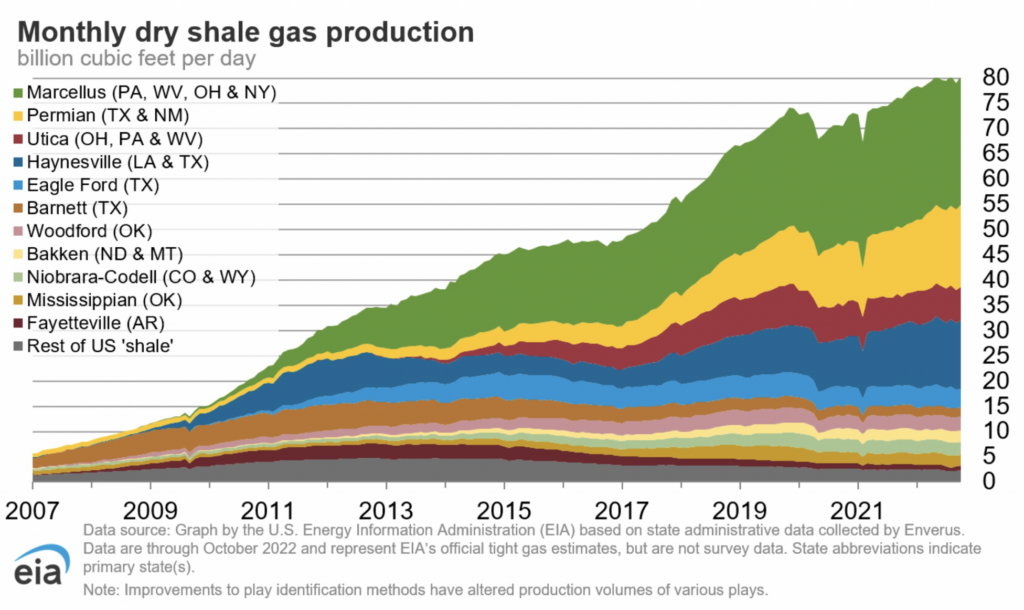

It is difficult to overstate the importance of fracking operations in the United States. In 2021, about 34.5 trillion cubic of dry natural gas was produced in America, equivalent to 94.6 billion cubic feet per day (Bcf/d). Shale gas produced through fracking accounted for more than 80% of this total.

Of course, any possible determination that fracking could have major seismic implications could not happen for quite some time. However, investors should monitor news of future seismic activity in the Permian Basin. Earthquakes of significant magnitude could hasten such discussions. In turn, any decision to require the curtailment of the low-cost fracking technique could force drillers to spend more to find natural gas, which would in turn force gas prices much higher.

Information for this briefing was found via the links provided and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.