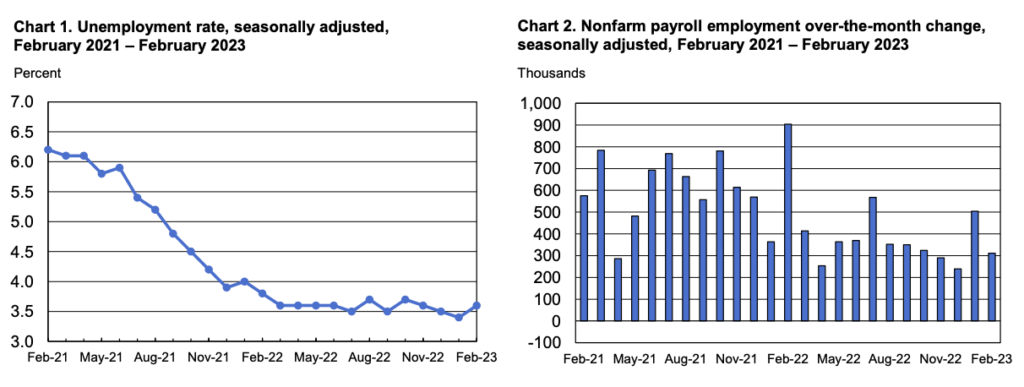

Latest data from the Bureau of Labour Statistics shows that job creation in the US is still as robust as ever, despite the Federal Reserve’s strong efforts to tame inflation and slow down an overheated economy.

February’s nonfarm payrolls jumped by 311,000, significantly above Dow Jones estimates calling for an increase of 225,000. The unemployment rate, meanwhile, rose to 3.6%, surpassing expectations calling for a reading of 3.4% thanks to a boost in the labour force participation rate, which hit 62.5%— the highest since March 2020.

However, taking a more optimistic turn for inflation was a less-than-expected increase in average hourly earnings, which rose 0.2% to 4.6% last month, less than the forecast of 4.8%. The latest job figures come on the heels of a downwardly revised January payrolls report, with the BLS initially reporting a gain of 517,000 before modifying to an increase of 504,000. Likewise, December’s figure was also revised downward by 21,000 to 239,000.

Despite the easing of wage growth increases, and lower job numbers, the Fed is likely to maintain its track of interest rate increases come its next policy meeting later in March. Markets are pricing in a 48.4% likelihood of a 50 basis-point increase, as per CME Group estimates.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.