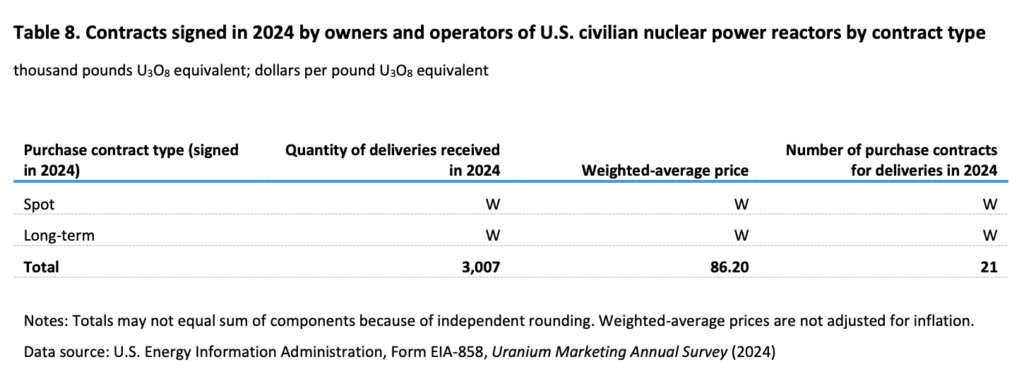

US civilian nuclear plant operators paid $86.20 per pound for 3.0 million pounds of uranium in 21 new contracts with deliveries in 2024, about 64% above the year’s $52.71 per pound delivered average, according to the Uranium Marketing Annual Report.

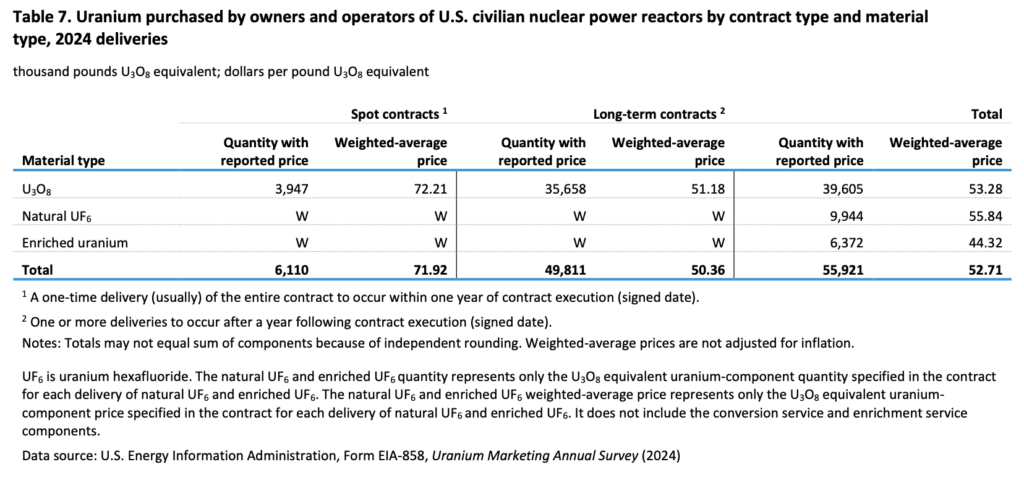

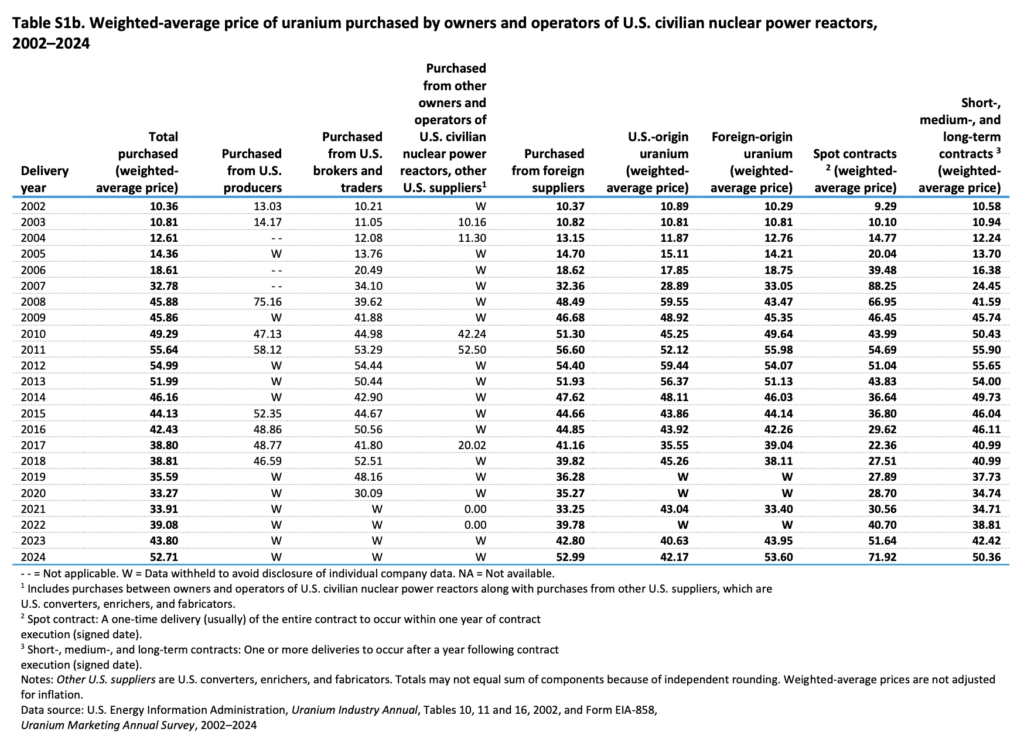

That premium stood well above both the spot cohort (9% of 2024 deliveries at $54.09 per pound) and the long-term cohort (91% of deliveries at $50.97 per pound), underscoring how near-term delivery timing was priced materially higher than prevailing delivery-weighted averages.

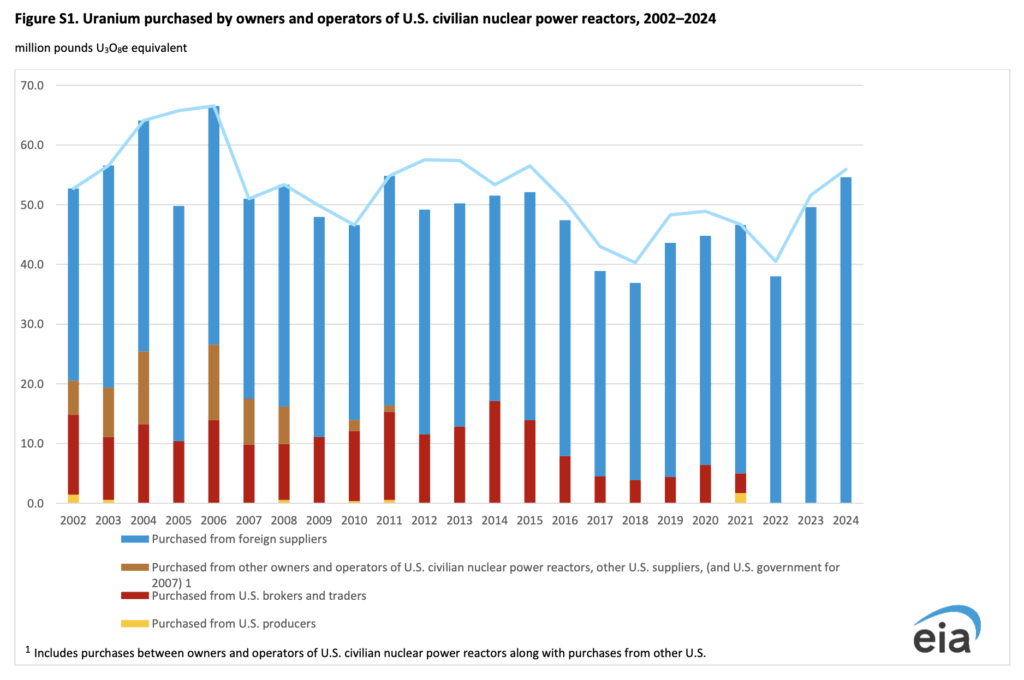

Behind the premium, utilities both bought and burned more fuel. Total purchases rose 8% to 55.9 million U₃O₈e pounds in 2024 (from 51.6 million pounds in 2023), while the delivered weighted-average price climbed 20% to $52.71 per pound (from $43.80 per pound), the highest since 2012. Reactor loads increased 10% to 50.6 million pounds (vs 46.1 million pounds in 2023), confirming higher throughput across the fuel cycle.

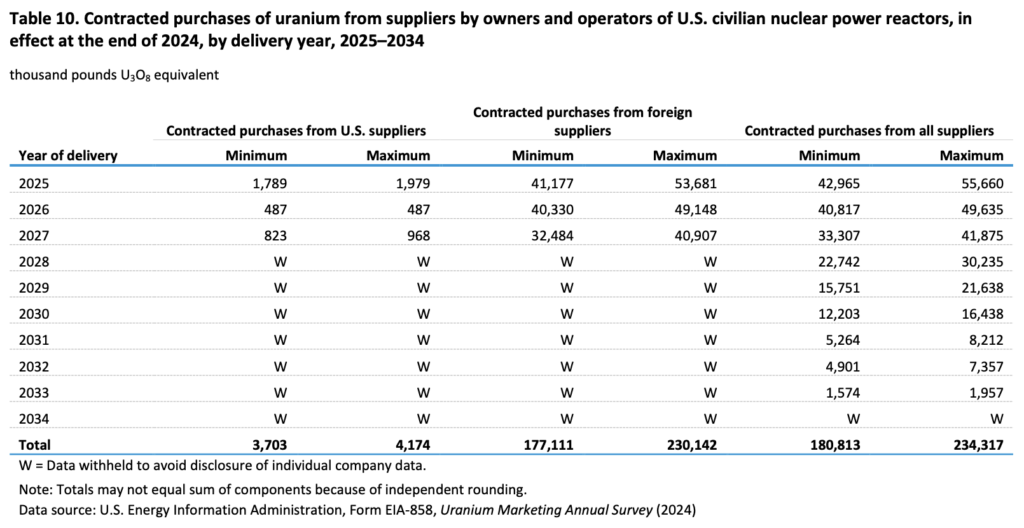

Coverage remains substantial but incomplete. At year-end 2024, utilities’ maximum deliveries under existing purchase contracts for 2025–2034 totaled 234 million pounds, while unfilled market requirements for 2024–2034 totaled 184 million pounds. Combined, the report’s “maximum anticipated market requirements” equal 418 million pounds over the next decade.

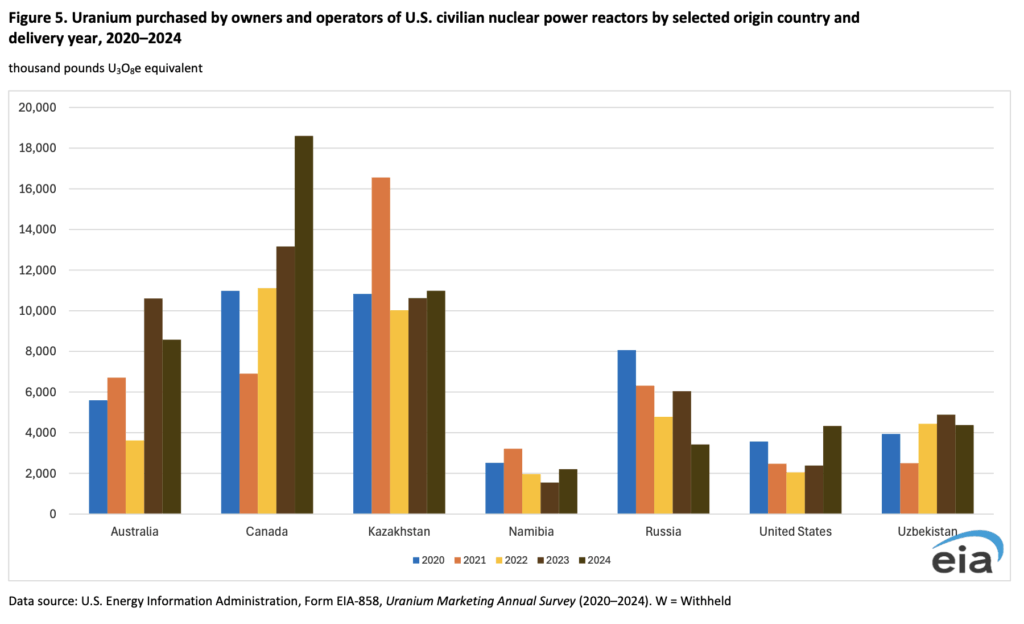

Supply stayed foreign-weighted even as US share ticked up. Canada supplied 36% of 2024 deliveries, Kazakhstan at 24%, Australia at 17%, Uzbekistan at 9%, and Namibia and Russia at roughly 4% each. US-origin material rose to 8% (from 5% in 2023).

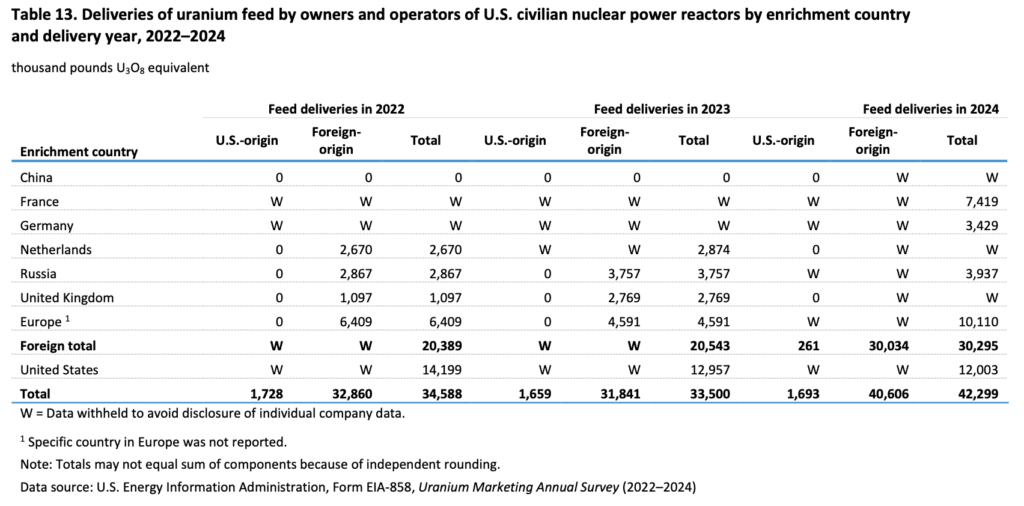

Utilities sent 42 million pounds of natural uranium feed to enrichers (28% to US enrichers, 72% to foreign). They bought 15 million SWU from eight sellers at an average $97.66 per SWU, down 9% from $106.97 per SWU in 2023. SWU origin remained diversified (19% US, 81% foreign including 20% Russia, 18% France, 15% Netherlands, 9% UK, 7% Germany). The decline in enrichment pricing contrasts with the higher uranium premiums for immediate material.

International trade flows also reflected higher price tiers outside utility deliveries. Foreign purchases by US suppliers and operators totaled 36 million pounds at $57.99 per pound, while foreign sales totaled 2.0 million pounds at $78.22 per pound.

Utilities added to stockpiles even as they paid up for prompt pounds. Total US commercial inventories ended 2024 at 167 million pounds, up 6% year over year. Meanwhile, utility-owned inventories rose to 126 million pounds (up 11%), while supplier inventories fell to 41 million pounds (down 5%).

The report sets the next release for June 2026, when 2025 activity will update the balance between contracted coverage and reported unfilled needs, and whether prompt-delivery pricing remains materially above delivery-weighted averages.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.