Last week, The Valens Company (TSX: VLNS) reported first quarter financial results. The company reported revenues of C$20 million, an increase of ~25% quarter over quarter, along with a net loss of C$5.6 million. The company reported a gross profit of C$4.7 million or a ~22% gross profit percentage.

Valens currently has nine analysts covering the company with a weighted 12-month price target of C$3.64. This is slightly up from the average before the results, which was C$3.53. One analyst has a strong buy rating, while the majority, seven analysts, have buy ratings. Only one analyst has a hold rating on the company. M Partners currently has the highest price target with C$5.00, while Raymond James has the lowest at C$2.50.

Canaccord Genuity reiterated both their 12-month price target of C$3.50 and their speculative buy rating on Valens after their financials. Matt Bottomley, Canaccord’s analyst, says that this is a strong start to 2021 as Valens continues to execute.

Bottomley writes that their top line, “met previously issued guidance but, nonetheless, showcase a reversion back to growth after seeing much of its top-line erode in FY20.” Revenue basically came in line with Canaccord’s C$20.6 million estimates. Bottomley says that Valens’ growth came from a “mild resurgence in tolling volumes,” as well as product sales which had an improvement of ~23% this quarter. He also expects that the stronger balance sheets from other names could translate to better business-to-business opportunities.

Interestingly, their K2 facility saw an ~8% increase in provincial sales, which has hit traditional licensed producers as they elect to sell down current inventory rather than restock. Because of this, Valens gained ~6% market share in the extract market in Alberta, British Columbia, and Ontario this quarter. Bottomley writes, “We continue to believe the long-term value for Valens rests in its provincial market share.”

Valens has flipped to positive gross margins after having to restructure its inventory during the fourth quarter. Bottomley writes, “We would expect to continue seeing improvements in this line as the company increases scale at its K2 facility; however, note that introduction of the GTA facility (once licensed) and LYF Foods may result in turbulence for the gross margin in the short term.”

Bottomley sees several catalysts in the next 12 months. They include, “a successful launch into the dried flower market, new/expanded white label contracts, entry into the US and other international markets, the licensing of Pommies, and continued fundamental performance.”

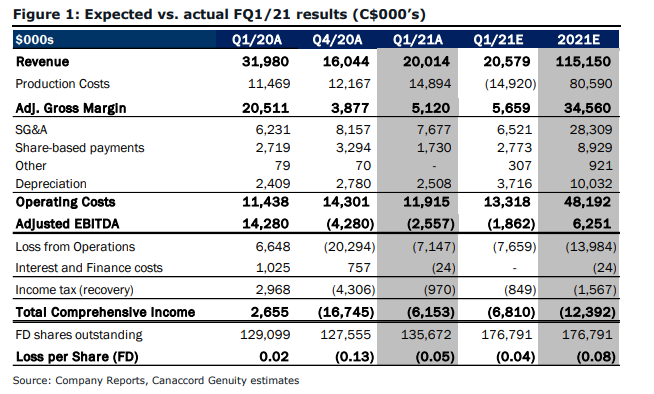

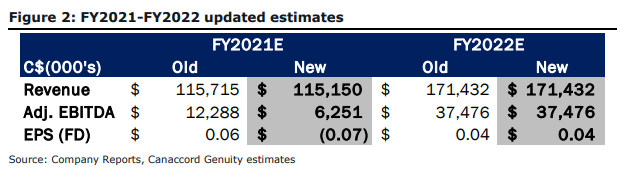

Bottomley adds that Valens international operations are not factored into their projections, which you can find below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.