Earlier this week, Antibe Therapeutics (TSXV: ATE) announced a strategic licensing deal with Nuance Pharm in China. The deal includes a U$20 million upfront payment, with U$100 million in milestone payments from Nuance Pharma. The agreement provides Nuance with exclusive rights to commercialize otenaproxesul, Antibe’s chronic pain drug, in China, Hong Kong, Macau, and Taiwan.

Antibe Therapeutics currently has six analysts covering the company with a weighted 12-month price target of C$15.68. This is down from the average last month, which was C$18.22. One analyst has a strong buy rating while the other five have buy ratings.

Yesterday morning, Canaccord’s analyst Tania Gonsalves increased her 12-month price target on Antibe Therapeutics to C$16.50 from C$15 and reiterated her speculative buy rating.

She makes note that China is the second-largest market with a 10% share of global pharmaceutical sales. She writes, “The infusion of US$20.0M into ATE is materially positive. A major overhang on the stock has been uncertainty around how the company will fund its adaptive Phase 2/3 trial (expected to cost ~$60.0M) with only $22.4M of cash on the balance sheet.”

Although they have been forecasting for Antibe to receive $20 million from a future licensing partner, she says that this came earlier than expected and, “was associated with a market we had not been valuing is incrementally positive to our outlook and valuation.”

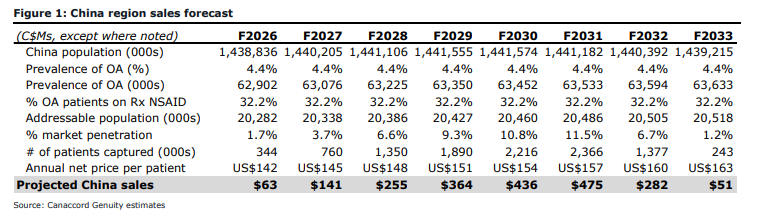

Below you can see the sales forecast from China as Gonsalves didn’t forecast any sales in China. The inputs she has for the data is consists of product launch in April 2025 and 4.5 years to peak, along with 12% market penetration at peak penetration.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.