This week has been a busy one for The Valens Company (TSX: VLNS). On Tuesday, the company announced they would be acquiring Citizen Stash in an all-share transaction pegged at $54.3 million. Citizen Stash is a licensed producer that specializes in premium flower and pre-rolls. Valens says that this acquisition will be accretive to the company in 2021 and 2022 before synergies, and that the company’s asset-light model aligns with Valens’ model.

Then on Wednesday, Valens announced that they have acquired Verse Cannabis for an immaterial amount. Valens management highlights that the deal will be accretive in 2021 and 2022 before synergies, while it bolsters Valens’ value offerings.

Analysts have yet to change their 12-month price targets on the news, leaving the consensus $4.42 estimate alone. Valens has 9 analysts covering the stock with 1 analyst having a strong buy rating, 7 having buy ratings and 1 has a hold rating. The street high sits at $5.75 from Stifel-GMP while the lowest comes in at $3.50.

Canaccord, whom held onto their $4.25 12-month price target and speculative buy rating, says “these transactions posture Valens in what are two of the more attractive recreational segments today,” and “we believe the combined platform is synergy-rich.”

However, they do point out that doing multiple acquisitions at once can cause an issue when it comes to integration, as they closed on two deals earlier this year. They also think that there could be some overlap between the company offerings now but say that the increased TAM offsets any potential losses that arise from this.

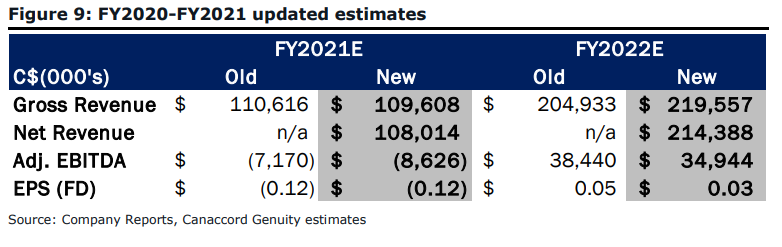

Canaccord defends not increasing their price target by saying that they are modeling conservatively. They have applied that market share will grow to 3% of the Canadian recreational market at peak, and assume margins will be in line with what the company is experiencing currently. They add, “Lastly, we have elected to take down our contract manufacturing estimates given the consolidation of Verse Cannabis sales and the potential for lost sales as the company ramps owned brands into new product verticals.”

Below you can see Canaccord’s updated 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.