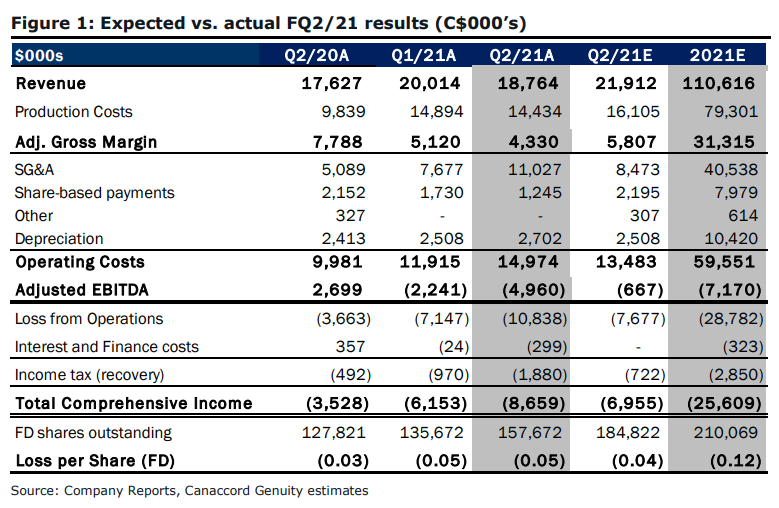

Last week, The Valens Company (TSX: VLNS) reported its second-quarter financial results. The company announced revenues of $18.8 million, down 6.2% and missing consensus estimates. Gross profits came in at $4.1 million, down from the previous quarter, while the company also posted an operating loss of $10.8 million.

Valens currently has 9 analysts covering the stock with an average 12-month price target of $4.42. The street high comes in at Stifel Canada with a $5.75 price target and the lowest sits at $3.50. Out of the 9 analysts, one has a strong buy rating, seven have buy ratings and one analyst has a hold rating.

In Canaccord’s note following the results, they lowered their 12-month price target to $4.25 but reiterate their speculative buy rating. They say that a “challenging macroeconomic backdrop in its focal markets of AB and ON” is the main reason for the revenue miss. They do look forward and say that the company has a “healthy pipeline of product releases” in the second half of 2021, which is expected to help Valens realize a strong quarter-over-quarter top line.

Below you can see Canaccord’s second quarter estimates. They say that the first quarter revenue was a function of the K2 facility launch and the company getting initial contracts. Additionally, they comment that management noted that sales were impacted by sourcing issues and COVID-19 headwinds. They believe that the company will soon bring an additional 40 SKUs to the market and distribution continues to expand to Quebec.

Canaccord adds that with the K2 facility now operational, Valens has the premier platform for the Cannabis 2.0 marketplace. The K2 facility has full edible capabilities and five different extraction types. Valens currently has a 5% market share in the 2.0 segment, but they believe that this number will continue to climb.

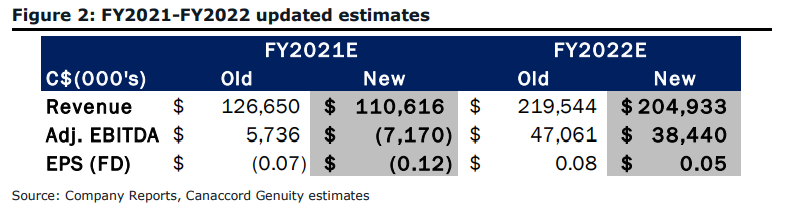

Canaccord has now elected to slow the quarter-over-quarter ramp in revenue estimates and lowered short-term margin expectations, bringing the 12-month price target down. Below you can see Canaccord’s new 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.