Last Wednesday, The Valens Company (TSX: VLNS) released its financial statements for the second quarter of 2020. Reported revenue came in at $17.6 million, which was below the consensus estimate of C$20.3 million. Canaccord Genuity’s estimate of C$18.4m was slightly off, but actual revenues were in line with Raymond James estimate of C$17.4m. Lower revenue was primarily attributed to reduced biomass shipments from extraction partners and volume and pricing pressure on bulk extract sales, which resulted in a ~55% decrease in tolling revenue and ~35% decrease in product sales.

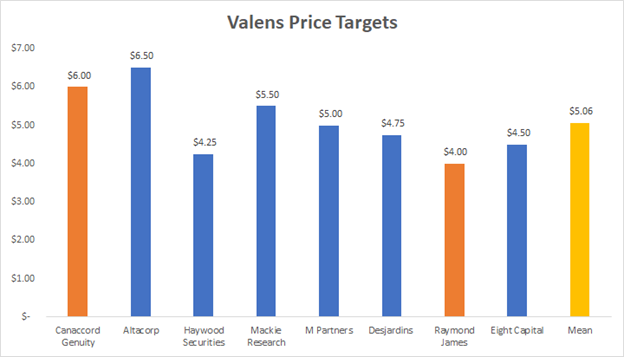

After Valens reported a ~45% decrease quarter over quarter in revenue, three analysts cut their 12-month price targets.

- Eight Capital cut to C$4.50 from C$6.00

- Haywood Capital cut to C$4.25 from C$6.00

- Canaccord Genuity cut to C$6.00 from C$6.50

Here are the updated price targets on Valens. The highest price target is C$6.50 from Altacorp analyst David Kideckel which represents a 211% upside while the lowest is from Neal Gilmer from Haywood with a C$4.25 price target or a 103% upside. The current mean price target is C$5.06 or 142% in perceived upside.

Canaccord Genuity analyst Matt Bottomley headlines this quarter as “turbulence for tolling; however, contract manufacturing progressing well.” Gross profit came in at ~36%, behind Bottomley’s estimate of ~45%. The lower gross profit was based on declining high-margin tolling services and rapid commoditizing of Valens classic business.

Bottomley also states that Valens is “well-positioned for burgeoning 2.0 market.” They believe that Valens has a competitive advantage that allows them to offer the premier third-party manufacturing contracts offering five different extraction types. He also notes that international execution is not factored into their valuation and presents even more upside to their models, suggesting that with their C$65m in liquidity and their recently increased headcount Valens will be able to identify opportunistic asset purchases that can make a big splash in the international front.

Raymond James analyst Rahul Sarugaser identified the move towards white label manufacturing and customer manufacturing, “as wise and being executed with vigor,” with five separate custom manufacturing agreements being announced since the beginning of June.

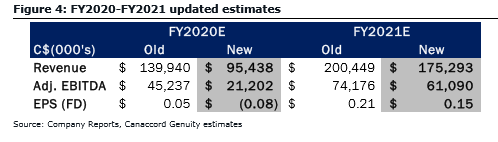

Canaccord Genuity updated their FY202O and FY2021 estimates for Valens, decreasing their revenue guidance by ~32% and ~13% respectively. Meanwhile they also cut their FY2020 adjusted EBITDA number in half, while slashing their FY2021 forecast by 18%. Canaccord’s earnings per share (EPS) estimate was also revised, dropping from $0.05 to -$0.08 in FY2020 and from $0.21 to $0.15 in FY2021.

The price slash by Canaccord follows the firm resuming coverage on the equity just two weeks ago, when they issued a price target of $6.50 per share.

Information for this briefing was found via Sedar, Refinitiv and The Valens Company. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.