Despite the resurgence of a COVID-19 wave, it appears that Canada’s housing market still remains resilient and stronger than ever.

According to the Real Estate Board of Greater Vancouver, the month of October saw home sales rise by 29% on a year-over-year basis, making its the second-best October on record. There were a total of 3,687 homes sold last month, which is an increase of 829 sales compared to October 2019. On a monthly basis, home sales rose by 1.2% since September, predominantly fuelled by a steady stream of sales in the detached homes category.

Likewise, the Vancouver benchmark home price rose by 0.4% and 6% from September 2020 and October 2019, respectively, settling in at $1,045,100. According to Board chair Colette Gerber, the housing market snapshot in October suggests that an increasing number of Canadians are reconsidering their housing situation in the wake of the ongoing pandemic crisis. Given that many workplaces have allowed their employees to conduct their work remotely, people are spending more time at home with their families.

Moreover, it’s beginning to look like the trend will likely continue into the foreseeable future. According to the weekly Nanos Research Group survey, housing market expectations remain positive, with 45% of respondents expecting that real estate value in their neighbourhood will rise within the next six months – the highest reading since the onset of the pandemic back in March. Conversely, only 13% of respondents foresee values declining, which is the lowest reading within the same period.

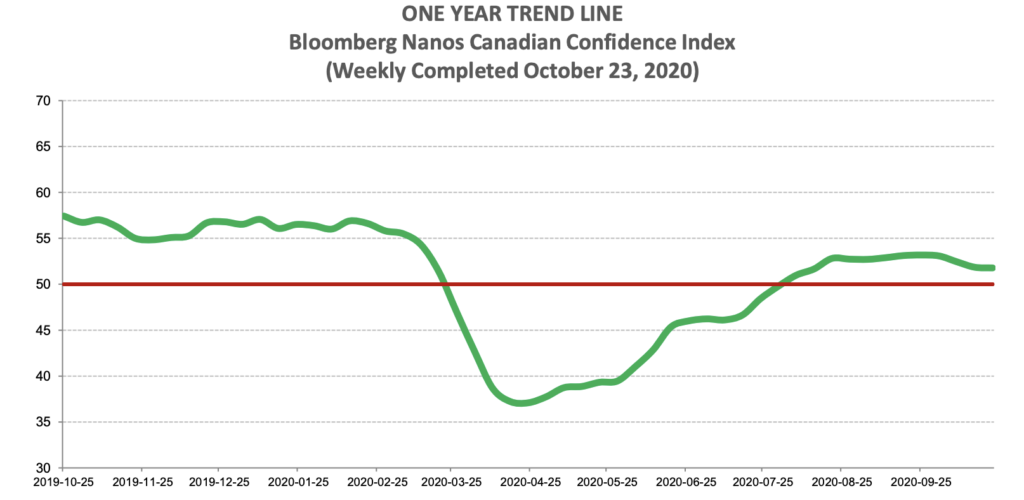

However, other areas of Canada’s housing market are displaying some worries, which was depicted in The Bloomberg Nanos Canadian Confidence Index reading for October. The index fell from 53.1 in September to 52.5 in October, suggesting that overall consumer confidence may be fading as the country heads into the fall and winter season.

Speaking to Bloomberg by telephone, TD Bank chief economist Beata Caranci noted that the current historically-low interest rates are attracting new individuals to the housing market that previously sat on the sidelines. Canada’s sales to new listings ratio, which measures housing market balance, has been sitting at the highest level in nearly 20 years, suggesting that demand has been significantly outweighing housing supply.

Information for this briefing was found via the Real Estate Board of Greater Vancouver, Nanos Research Group, and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.