On November 16th, Verano Holdings (CSE: VRNO) announced its third quarter financial results. The company reported revenues of $207 million, a 4% sequential increase and a 106% year-over-year increase. Gross profits meanwhile were $133 million, or a 64% gross margin, up from $100 million and 50% of revenue last quarter. Third quarter adjusted EBITDA was $111 million, or a 54% margin, up from $81 million and 41% of revenue last quarter.

Verano currently has 8 analysts covering the stock with an average 12-month price target of C$38.77, an upside of 150% from the current stock price. Out of the 8 analysts, 2 have strong buy ratings and the other 6 have buy ratings. The street high sits at C$48 from BTIG while the lowest comes in at C$29.50.

In Canaccord’s quarterly review, they reiterate their buy rating but lower their 12-month price target from C$35 to C$30 saying, “Transient revenue headwinds offset by a strong rebound in margin profile.”

For the results, Verano came in below Canaccord’s $219.66 million revenue estimate but beat on gross profits and adjusted EBITDA. Canaccord says that a change in accounting policy regarding earn-outs drove some of the adjusted EBITDA beat but writes, “the company remains one of the most profitable MSOs in the sector to date.”

For revenue, Canaccord seems fairly disappointed with the results, although many multi-state operators missed on revenues. Canaccord expected Verano to meet or exceed their $219.66 million estimate due to opening 7 new dispensaries and new cultivation and production in Pennsylvania.

Canaccord notes that management pointed to some regulatory delays in Pennsylvania, New Jersey, and Massachussets as the reason for a more muted quarter. Additionally, Canaccord says that Verano ended the quarter with US$57 million in cash and a run rate of US$16 million in free cash flow.

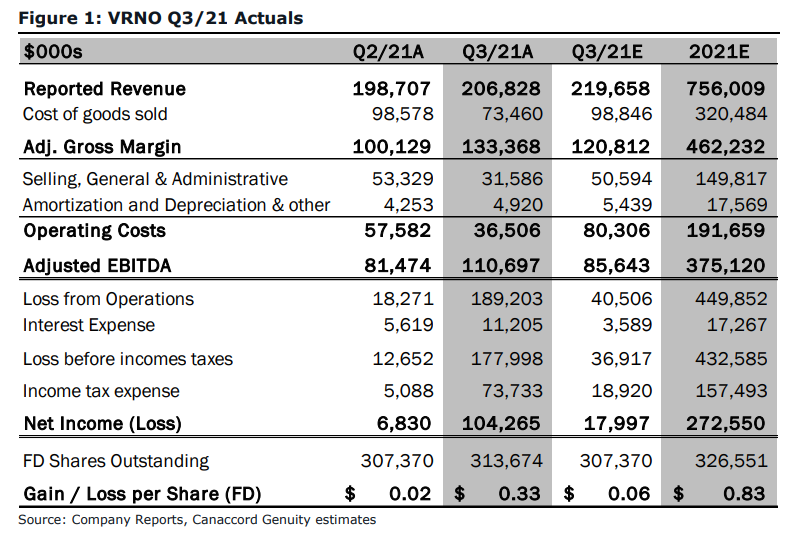

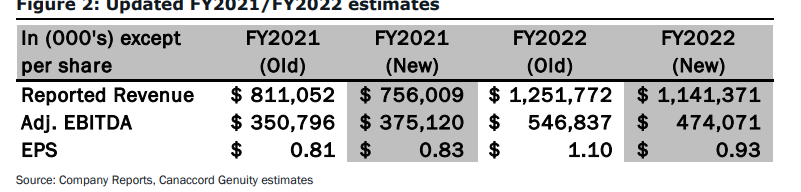

Below you can see Canaccord’s updated full year 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.