PI Financial last week initiated coverage on Verano Holdings (CSE: VRNO) with a long-term price target of C$22 and a buy rating. The analysts are expecting a return of 165%, believing that the company has showcased growth in key operating metrics and is one of the leading US MSOs. PI Financial believes that with the acquisition of Goodness Growth expected to close during the fourth quarter, “the company is set to solidify its position as a leading player in the large-cap MSO peer group.”

Verano currently has 11 analysts covering their stock with an average 12-month price target of C$23.28, or an upside of 181%. Out of the 11 analysts, two have strong buy ratings, eight have buy ratings, and the last analyst has a hold rating on the stock. The street high price target sits at C$34 and represents an upside of 310%.

PI Financial says one of Veranos’ largest selling points is that the company has low debt leverage relative to its peers, with a debt/EBITDA ratio of 1.15x compared to the average of 2.83x. They say that Verano’s ability to not use debt to finance it’s operations allows the company to have the “optimal capital structure,” and note that the company has not used any of its own assets for sale-leasebacks which could be a potential source of funding. Verano currently holds $515.7 million in PP&E, of that, about $200 million is either land or buildings and improvements.

Another selling point is Verano’s successful track record in M&A while expecting that the Goodness Growth acquisition will go smoothly. PI Financial believes this acquisition will give Verano the first movers advantage in a few limited license states such as Minnesota, “while providing exposure to key states like New York.”

Lastly, PI Financial says that the company has a “Compelling growth strategy through capital expenditures.” The company currently has one of the largest capital expenditures year to date. It is not expected to slow down as it tries to grow its position in Florida, Maryland, and Connecticut, which are exepected to legalize recreational sales in the near term.

One overhang PI Financial notes is that Verano’s high taxes payable is an operational risk but believes that this is a part of the company’s strategy to preserve cash. The company currently has taxes payable equal to 174% of its current cash balance. They say that Verano continues to pay its state-level taxes but defers it’s federal taxes for a 6% annual fee.

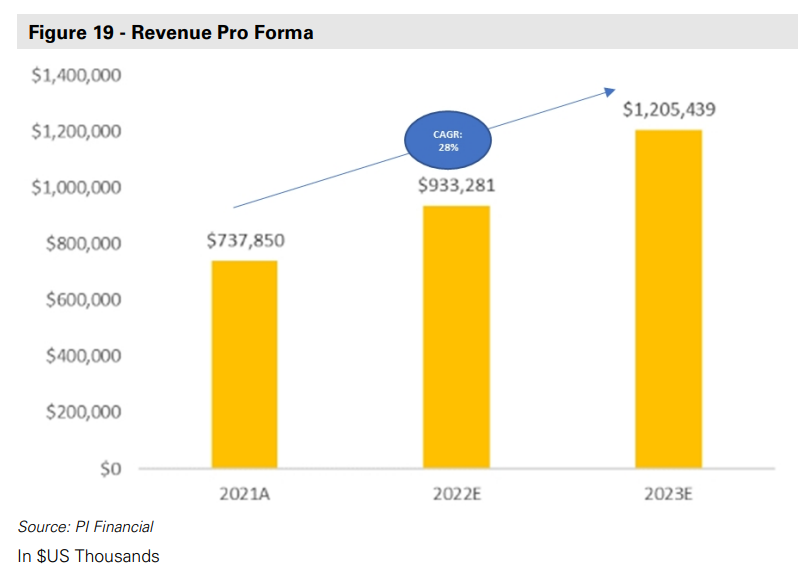

PI Financial is forecasting Verano to grow its revenues to $1.2 billion by the end of 2023, with revenues coming in at $933.3 million for the full year of 2022, making the three-year CAGR 28%. They believe this will be attainable as Verano looks to open more than 90 additional retail locations by the end of the year. This will give the company stronger vertical integration, which will allow “the Company to capture a huge share of the retail market which would provide significantly higher revenue and market share going forwards.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.