Village Farms International (TSX: VFF) announced that they will be reporting their third quarter financials before the market opens on November 9th.

Analysts have a consensus C$23.80 12-month price target on the company, via a total of 7 analysts, with 1 analyst having a strong buy rating, and the other 6 have buy ratings on the company. The street high comes from Raymond James with a C$33.79 price target, and the lowest target comes from Craig-Hallum with a C$17 price target.

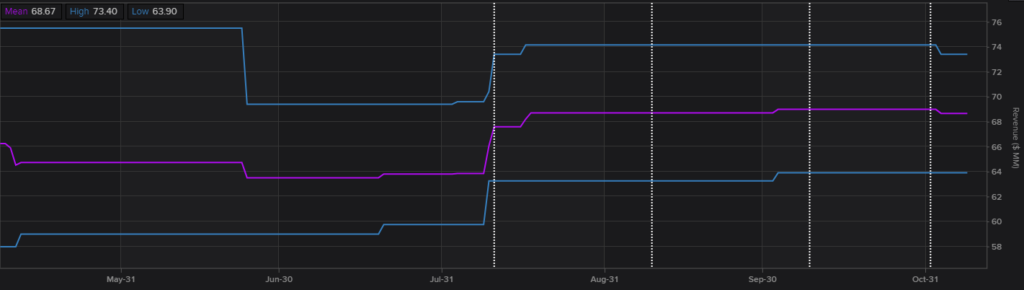

Seven analysts have revenue estimates for the third quarter. The mean between all 7 is US$68.67 million; this number has been revised slightly upwards from US$66.25 million at the start of May. The street high is US$73.40 million while the lowest sits at US$63.90 million.

Only 3 analysts have estimates for what this quarter’s gross profit margin will be. They expect the profit margin to come in at 13.03%, with this number being flat at the start of May. Street high is 15% estimate and the lowest sits at 12%.

Onto EBITDA estimates, there are currently 7 analysts who have third quarter EBITDA estimates. The mean is currently US$3.54 million, with this number being revised downwards from US$5.23 million at the start of May. Street high sits at US$6.4 million EBITDA and the lowest being a (US$1.35) million estimate.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

numbers are off. 8 analysts with Pablo from CF being the low at 11.50usd. BMO is next at 16 and then CH at 17.