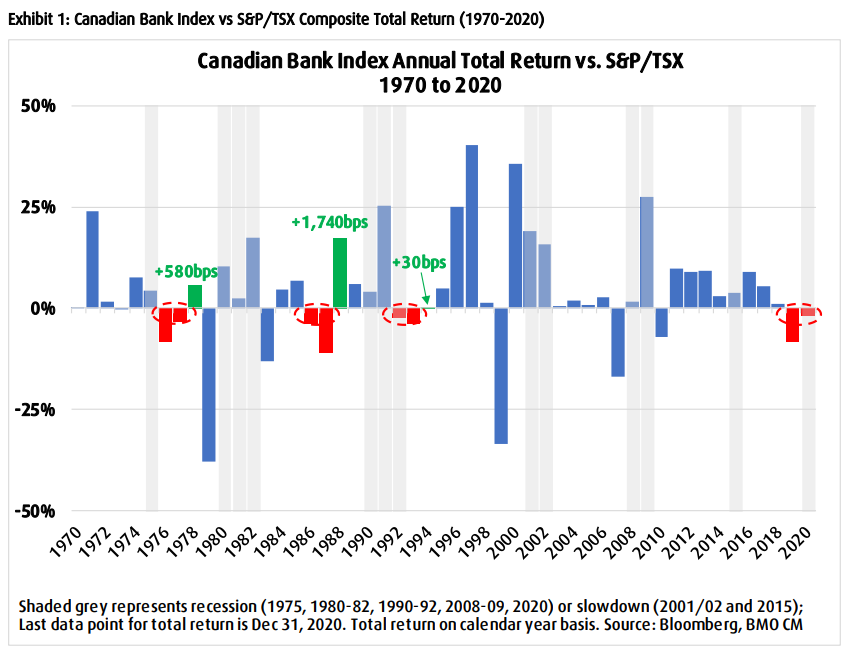

In a note sent out to investors on January 3rd, BMO Capital Markets headlines “Bank Index Underperforms Again in 2020; History Suggests Outperformance in 2021.”

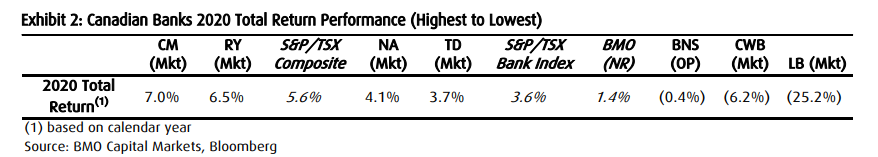

Sohrab Movahedi, BMO Capital Markets Canadian bank analyst, predicts that the basket of Canadian banks will outperform in 2021 after lagging behind the S&P and TSX for the second consecutive year. The Canadian bank index ended up 3.6% in 2020, while the median total return of 45 bank stocks was roughly -12%.

Movahedi writes, “since 1970, there have been three instances when the bank index underperformed the composite in consecutive years, and in each case, the banks outperformed the following year by an average of 780 bps.”

Movahedi believes this could be achieved through a multitude of paths such as earnings growth, dividend yield, and some multiple expansions and specifically identifies Bank of Nova Scotia and CIBC as the top winners. Movahedi adds that for investors who like to take the contrarian approach, they should be looking at the Canadian banks. Specifically, Bank of Nova Scotia, BMO, and National Bank of Canada over TD, Royal Bank, and CIBC.

Among the big six, CIBC was the best performer with a 7% return throughout the last year. On the flip side Laurentian was the worst performer for 2020, with a decline of 25.2%.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.