Yesterday, Village Farms (TSX: VFF) (NASDAQ: VFF) indicated that they would become a 16% shareholder in DutchCanGrow Inc, a Netherlands based company focused on the emerging Dutch recreational market. The ventures primary goal is to become one of only ten licensed cannabis growers, which includes a total of 78 shops participating in this experiment called Closed Cannabis Supply Chains or WECG. Raymond James issued a note following this release, and although they did not change their price target or rating on the stock, they remain bullish.

Raymond James estimates that the total supply needed for the current WECG is 650,000 kilograms of cannabis annually, but split ten ways, is only 65,000 kilograms per annum. They also believe the whole Dutch cannabis market is estimated at C$2.5 billion a year, with WEGG estimated to account for only 10% of that figure, or C$250 million per year.

The firm says that the revenue this joint venture will bring in could be around the C$4 million mark initially. However, if/when the Dutch expand their WECG program nationally, the revenue could be 10x this and bring in C$40 million in revenue for Village Farms – a much more significant figure.

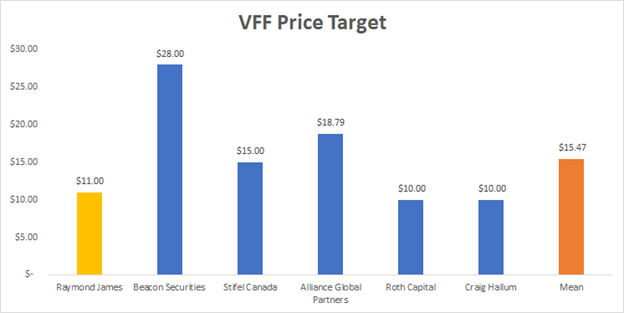

Raymond James remains very bullish on the equity, saying that in their view the stock is “materially undervalued.” However, their price target does not reflect their extreme bullishness, as their price target upside is only 57% compared to the mean being 121% and the highest being 300%.

Information for this briefing was found via Sedar, Raymond James and Village Farms International. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

“Raymond James estimates that the total supply needed for the current WECG is 650,000 kilograms of cannabis annually… WEGG estimated to account for only 10% of that figure, or C$250 million per year.”

I think there is a typo in the article. 650,000 kilograms at $250 million works out to about $0.38/gram, which is extremely low. If you check the press release the current WEGG is 65,000 kg, which works out to $3.85/gram and 6,500 kg annually per cultivator. $3.85 X 6,500 X 16% ownership in DutchCanGrow = $4M (which is described in paragraph 3).