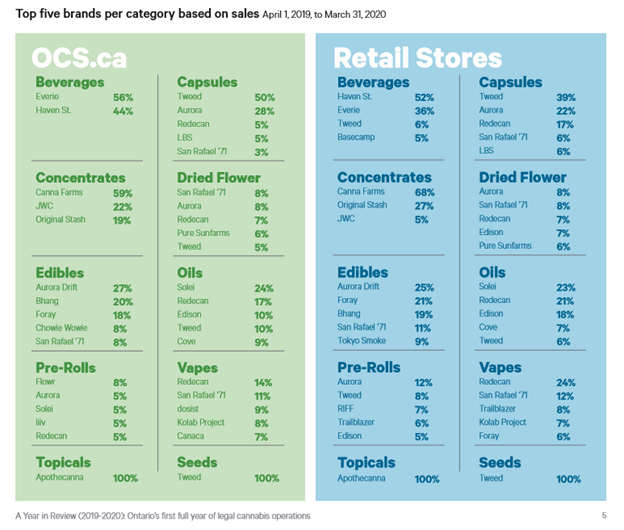

Late Monday night, the Ontario Cannabis Store released a 2019-2020 Year Review, where they provide a bunch of data and stats. One of the graphics they offered was the top five brands per category based on sales period starting April 1st, 2019 to March 31st, 2020. Notably, Village Farms’ (TSX: VFF) (NASDAQ: VFF) joint venture Pure Sunfarms performed remarkably well n terms of commanding market share.

Stifel GMP and Raymond James have both put out a note highlighting the strengths of Village Farms Pure Sunfarms compared to the other LP brands listed in the graphic. Although there was no material change such as estimates, price targets, or ratings, both firms had an overwhelming amount of positive things to say around Pure Sunfarms.

Stifel GMP’s analyst Andrew Partheniou said that based on Headset and Ontario Cannabis Store data, Pure Sunfarms is a top-selling Ontario brand capturing 6% of both online and in-store flower sales making them 4th and 5th overall respectively. They achieved this despite only selling in the province for six months while all the other LP’s have had one year of sales accounted in the breakdown. Stifel GMP says, “we believe PSF is the best-selling brand in ON, outperforming its closest competing brand by an est. ~50%.”

Stifel GMP’s analyst goes on to say that Pure Sunfarms is primed to take a good share of the C$500m illegal Ontario market because Pure Sunfarms prices their products 15-20% lower than other LP’s at C$4.20 to C$9 per gram while keeping a high-quality standard of product.

The analyst at Stifel GMP also notes that Pure Sunfarms “generates double the sales/SKU of closest peer in ON.” While saying that they make 3x the sales, the second closest peer, Stifel GMP, notes the idea that Pure Sunfarms could add additional SKU’s and their sales gap could narrow and would be able to overtake other LP’s in a short time.

Commenting on the data, Raymond James Analyst Ruhal Sarugaser stated, “Pure Sunfarms Punching WAY Above its Weight.” Reiterating the same points that Stifel GMP did except for one point, Sarugaser also indicates that heavyweight LP’s such as Canopy Growth and Aurora, due to their higher cost of goods sold (COGS), are delivering sub C$1 contributed margin per gram sold while Village Farms Pure Sunfarms grows cannabis for C$0.80 a gram and doubles the added margin of the large players while having six straight quarters of positive EBITDA, which in Raymond James view makes the firm “materially undervalued.”

Village Farms last traded at $7.85 on the TSX, well below Stifel GMP’s price target of $15 a share, and Raymond James’ target of $11.

Information for this briefing was found via Sedar and Village Farms International. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.