Vireo Health (CSE: VREO) reported its second-quarter financials’ on August 26th, indicating revenue for the period was $12.2 million, a 70% year over year increase. Retail revenue was $9.2 million, a 46% increase year over year and was attributed to greater patient enrollment and higher average revenue per person. Wholesale revenue was $1.6 million, or a 256% increase year over year.

There are only three analysts who cover Vireo Health. Eight Capital increased their 12-month price target to C$1.50 from C$1 and raised their rating to buy from a hold rating prior, while Canaccord reiterated their C$2 price target and speculative buy rating. M Partners, who has the lowest price target of C$1.25, also reiterated their buy rating this morning. The average 12-month price target is C$1.58 or a 103% increase.

In Canaccord’s note, analyst Matt Bottomley headlines “Q2/20 review: A relatively flat quarter as VREO continues to shift to core markets.” Vireo’s revenue came in just below Bottomley’s estimate of $13.2 million, while even though gross margins increased to 29%, they still fell short of the 31% estimate. Management noted that they will be investing in their core markets further, for which Bottomley says will gradually get gross margins to over 40%.

Although Canaccord says that Pennsylvania is one of the more attractive medical markets, Vireo selling their cultivation and production assets for ~U$37 million, with an 18-month option to purchase Vireo’s Pennsylvania retail assets for another U$5 million in cash, “was much needed and should allow VREO to continue building out its presence in its other core markets.” With this cash infusion, Bottomley believes Vireo has enough cash to reach their management’s current objectives.

Turning the focus to Vireo’s five remaining core markets of Minnesota, New York, Maryland, and New Mexico, the analyst states that this mix of assets, “still have attractive optionality and upside.” Vireo’s management states they will be putting another $8-$9 million into these operations till the end of the year to reaccelerate their top line and work towards being cash flow positive by the second half of 2021.

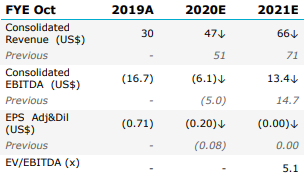

Although Bottomley did not change Canaccord’s price target or rating, he slightly changed his full year 2020 forecasts. The firm now forecasts revenue and adjusted EBITDA to come in at $47.5 million and -$6 million, respectively, versus the prior estimate of $51.4 million and -$5 million.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.