On April 14, Vizsla Silver Corp. (TSXV: VZLA) reported constructive assay results from a step-out drilling program at the southern end of its Napoleon prospect. Napoleon is part of Vizsla’s Panuco silver-gold project in Mexico.

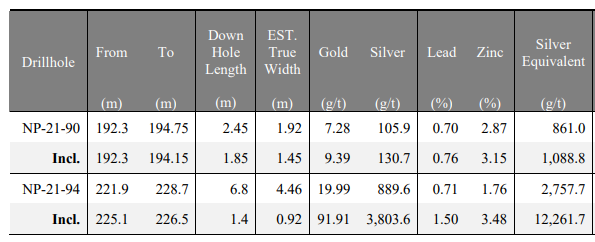

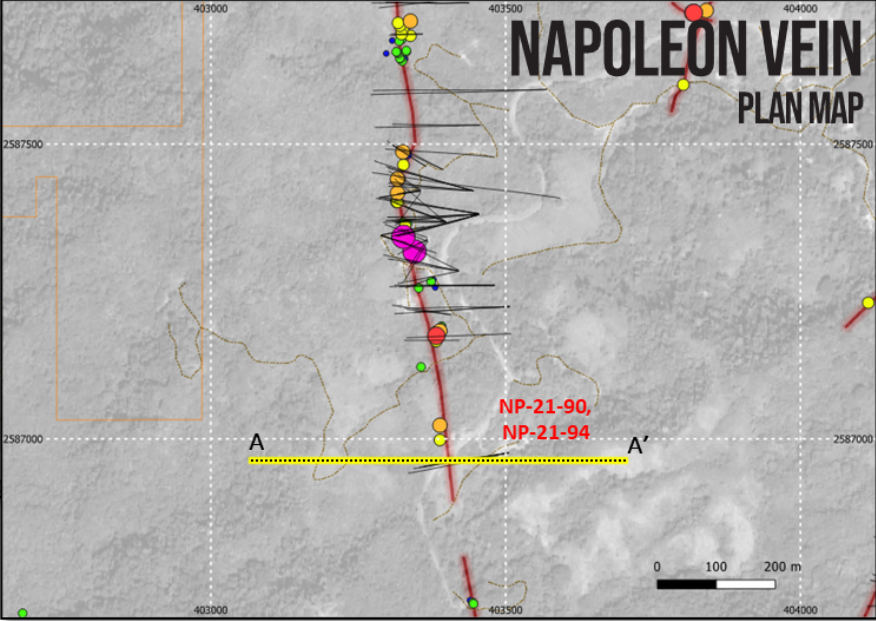

The high-grade drilling results, which include a 4.46-meter span with a silver-equivalent (AgEq) concentration of 2,758 g/t of resource and a separate 1.92-meter intersect with an AgEq content of 861 g/t, demonstrated continued mineralization on the Napoleon vein. The results effectively extended mineralization by 300 metres on a drilled-basis for the target.

Equally important, high-grade assay results have now been returned on 570 meters of the 2,500-meter strike length on Napoleon. The 570-meter span remains open in all directions. The company has drilled 11 more holes on the 570-meter length and hopes to determine whether there is continuous mineralization over its entire distance. Assays remain pending on these holes.

Vizsla has four drilling rigs operating on the 2,500-meter strike length on Napoleon and hopes it will become an entire vein field. If that proves to be the case, production at the Panuco property could potentially occur more quickly than at many deposits, as Vizsla has the El Coco mill under option per an agreement with Minera Rio Panuco SA.

El Coco is a fully permitted, operational 500 tonne-per-day flotation plant. (To exercise the option agreement, Vizsla must incur US$2 million of capital expenditures by August 2021, and pay a total of US$23 million in cash over a five-year period ending in August 2026.)

Vizsla’s Panuco project is located about 80 kilometers south and in the same mining belt as First Majestic Silver Corp.’s (TSX: FR) San Dimas Mine. That mine produced 6.3 million ounces of silver and 87,400 ounces of gold in 2019. Its lifetime production totals 582 million and 11 million ounces of gold and silver, respectively.

In the first half of 2021, the company plans to drill a total of 40,000 meters on Panuco, using seven drilling rigs, at a total cost of about $12 million. This program is fully funded (see below).

Strong Balance Sheet

As of January 31, 2021, Vizsla had about $23.6 million of cash and no debt. On April 1, its cash balance was about $20 million, as per its latest investor deck. The company’s operating cash flow shortfall has averaged about $2 million per quarter over the last three reported quarters.

| (in thousands of Canadian dollars, except for shares outstanding) | 3Q FY21 | 2Q FY21 | 1Q FY21 | 4Q FY20 | 3Q FY20 |

| Operating Income | ($2,733) | ($4,320) | ($2,061) | ($975) | ($2,320) |

| Operating Cash Flow | ($2,331) | ($2,271) | ($1,345) | ($972) | ($1,314) |

| Cash | $23,581 | $29,394 | $33,529 | $2,584 | $4,522 |

| Debt – Period End | $0 | $0 | $0 | $0 | $0 |

| Shares Outstanding (Millions) | 91.2 | 91.0 | 88.6 | 58.9 | 57.9 |

While Vizsla’s assay results at the Napoleon prospect have been encouraging, any significant deviation from this trend in the future would be a negative for the stock. In addition, if Vizsla, a pre-revenue company, were to decide to expand its drilling beyond what is currently contemplated, it could have to raise additional equity to fund that effort.

It is rather uncommon for a junior miner to have seven (possibly eight) drilling rigs engaged at the same time. If drilling results from this effort continue to be encouraging, and factoring in Vizsla’s option agreement on the El Coco mill, it is possible that Vizsla could transition reasonably quickly from an exploration stage mining company to a producing one. That transformation frequently includes a positive re-rating of a miner’s shares.

For what its worth, the company recognizes this rare opportunity, with CEO Michael Konnert stating in the most recent news release, “With the El Coco mill under option, we have commenced studies into metallurgy, engineering, mill upgrades and tailings reprocessing opportunities to expedite the short-cut to production that is so unique to Vizsla’s opportunity at Panuco.”

Whether that opportunity is used to its full potential however is anyone’s guess.

Vizsla Silver Corp. last traded at $2.01 on the TSX Venture Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.