As was widely expected, Wall Street has come to the rescue. A group of major banks are pledging to deposit a combined $30 billion into First Republic Bank, in an effort to assure markets and the public that the US financial system isn’t ripping at the seams, contrary to popular belief.

In a hail Mary attempt to regain confidence in the game that is Wall Street, JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo agreed to deposit $5 billion each into First Republic, Morgan Stanley and Goldman Sachs will put up approximately $2.5 billion, while US Bancorp, Truist, State Street, PNC, and Bank of New York Mellon will each deposit $1 billion. “This action by America’s largest banks reflects their confidence in First Republic and in banks of all sizes, and it demonstrates their overall commitment to helping banks serve their customers and communities,” the group of banks wrote in a news release.

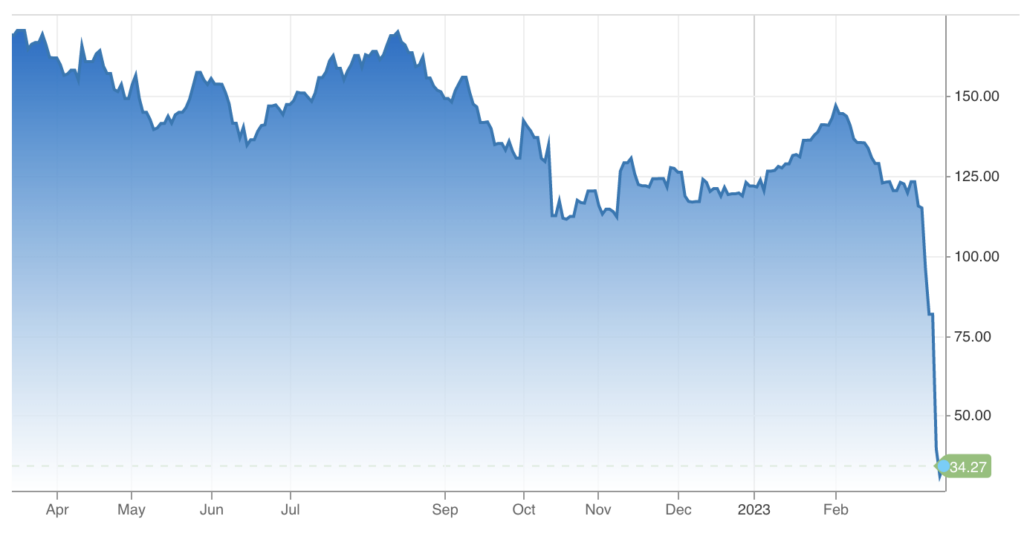

The latest announcement comes after Silicon Valley Bank and Signature Bank went insolvent last week, sending First Republic’s shares plummeting in contagion because it too, holds a substantial number of uninsured deposits. On Sunday, First Republic CEO Mike Roffler reassured investors that the bank had access to about $70 billion in liquidity, and could raise even more cash by tapping into the Fed’s Bank Term Funding Program; still, markets called bluff, sending the stock price down from over $110 on March 8 to less than $30 as of current.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.