Amid all the chaos of leading banks capsizing into regulators hands, leaving depositors wary of recovering their investments, an online feud heats up between Craft Ventures General Partner David Sacks and famed short seller Marc Cohodes.

Major banks like Silicon Valley Bank, Silvergate Bank, Signature Bank, First Republic Bank, and Credit Suisse have fallen one by one as they facing bank runs that ran them illiquid. Regulators and Wall Street firms were quick to rescue the collapsing banks by hoping to infuse capital through acquisitions or auctions.

However, the discussion has turned a different direction, with the focus now on who made the most out of the bank collapses. A prevailing theory is venture capitalist’s like Sacks’ “incited” the panic on bank runs after they “pulled out” before the collapse.

The same media which mischaracterized our efforts as “spreading panic” would have feasted on the stories of small businesses losing everything if those bank runs had been allowed to occur. And they would have held themselves blameless for the ensuing panic.

— David Sacks (@DavidSacks) March 17, 2023

The fact that the author deleted their tweet tells you everything you need to know about the hoax they’re trying to create. But here it is for posterity. pic.twitter.com/9o3tXbO0Eb

— David Sacks (@DavidSacks) March 17, 2023

If corporate media covers a bank failure, it’s educating the public. If a podcast does it, it’s panicking the public. They hate alternatives.

— David Sacks (@DavidSacks) March 18, 2023

Sacks defends himself by highlighting that it was necessary to sound the alarm for other depositors to pull their money and save their investment, in addition to highlighting that the banks’ liquidity problems were already reported before he (and others in his circle) talked about the bank runs.

Enter Cohodes

It is quite unclear on how deep the animosity between Sacks and Cohodes has run but it is apparent that there’s no love lost between the two.

In an interview, Sacks described the recent legislation passed under the Biden administration to have caused inflation; hence, the Federal Reserve’s response to hike interest which caused the banks to collapse due to high borrowing costs.

.@DavidSacks tells @jimmy_dore that the American Rescue Plan, Build Back Better Act, CHIPS Act, and the Inflation Reduction Act resulted in a surge in inflation, prompting the Fed to raise interest rates at an unprecedented rate, which then caused these banks to collapse:

— kanekoa.substack.com (@KanekoaTheGreat) March 16, 2023

"The… https://t.co/7iPcJ8cer8 pic.twitter.com/3VDspxnlxH

Cohodes hit Sacks in his efforts to explain the bank collapses and how the government seems to be the one that failed in this scenario.

I am sure we will start hearing from Asshat @DavidSacks and @BillAckman on the Cartoon Network aka @cnbc in a few hours on how the Government needs to do more to save the Billionaires

— Marc Cohodes (@AlderLaneEggs) March 15, 2023

For Cohodes, the behind-the-scenes timeline needs to be looked at in terms of how Sacks was allegedly tipped off so he could pull out his VC’s money in Silicon Valley Bank before the eventual collapse.

Because you got tipped and took it out right before you Asshat.. Just a disgrace https://t.co/J9d0kvJvua pic.twitter.com/XcGXvHxpKF

— Marc Cohodes (@AlderLaneEggs) March 18, 2023

@DavidSacks this is the question that needs to be answered instead of running your Pie Hole https://t.co/5WfZYsG1y4

— Marc Cohodes (@AlderLaneEggs) March 18, 2023

How much did You or your companies Pull out of SVB before the collapse.. @ewarren I think you should ask VCs like @DavidSacks how much they yanked from SVB along with the @SECGov and @SDNYnews https://t.co/z6r4UKhqgW

— Marc Cohodes (@AlderLaneEggs) March 18, 2023

The clash

Sacks shot back at Cohodes’ tweet that said it is “not the end of the world if 200-500 banks go under” by replying that the short seller is the “leading proponent for the ‘let it burn’ camp,” before referring to Cohodes as an “angry psycho.”

Leading proponent for the “let it burn” camp finally admits what we were dealing with: 200-500 bank failures and that’s just for starters because nobody knows how to stop a bank run when it gets that big. God help us if these angry psychos ever get the wheel. https://t.co/Ry2VO2sVkh

— David Sacks (@DavidSacks) March 18, 2023

Cohodes retorted and doubled down on his point of query regarding how — and how much — Sacks pulled out before Silicon Valley Bank fell.

Angry psycho confirmed.

— David Sacks (@DavidSacks) March 18, 2023

Later on, Cohodes zeroed in on Sacks and said to be looking into him and his companies in their role with the bank’s collapse.

@DavidSacks @nntaleb if this is True I would think its somewhat problematic David.. I think I will contact the Feds on Monday.. Cheers pic.twitter.com/cBWfm6LXEY

— Marc Cohodes (@AlderLaneEggs) March 18, 2023

Wait till the Feds look into emails between @DavidSacks and this Inbred VC crowd and "their" bank.. Who knew "what when and what did they do". I wonder if any of them Shorted The Stock or Bought Puts.. Boy would that be rich or what? https://t.co/CahdUQdSwS

— Marc Cohodes (@AlderLaneEggs) March 18, 2023

@DavidSacks Now that $SI and $SBNY are finished, I might as well look into your dealings along with your Grifting friends.. No problem, I am a patient man and you are not well liked and few have respect for you given who has reached out.. https://t.co/3SrIcjJuHc

— Marc Cohodes (@AlderLaneEggs) March 18, 2023

I am game.. He can bring all bis companions with him https://t.co/OojjgIIOll

— Marc Cohodes (@AlderLaneEggs) March 18, 2023

In particular, Cohodes revived a clip of a 2021 podcast guesting by Sacks in which the venture capitalist discussed the firm’s investment in Solana.

Kind of thinking this isnt a bad place to dig @DavidSacks https://t.co/xFxj69Ju9e

— Marc Cohodes (@AlderLaneEggs) March 19, 2023

A dimension to this story that we can’t forget.

— Joe Weisenthal (@TheStalwart) March 12, 2023

Many of the leading folks in the industry that now wants Powell to step up and protect them spent the last 5 years telling lies and breeding cynicism about the Fed as pretext to sell cryptocurrencies to retail bagholders.

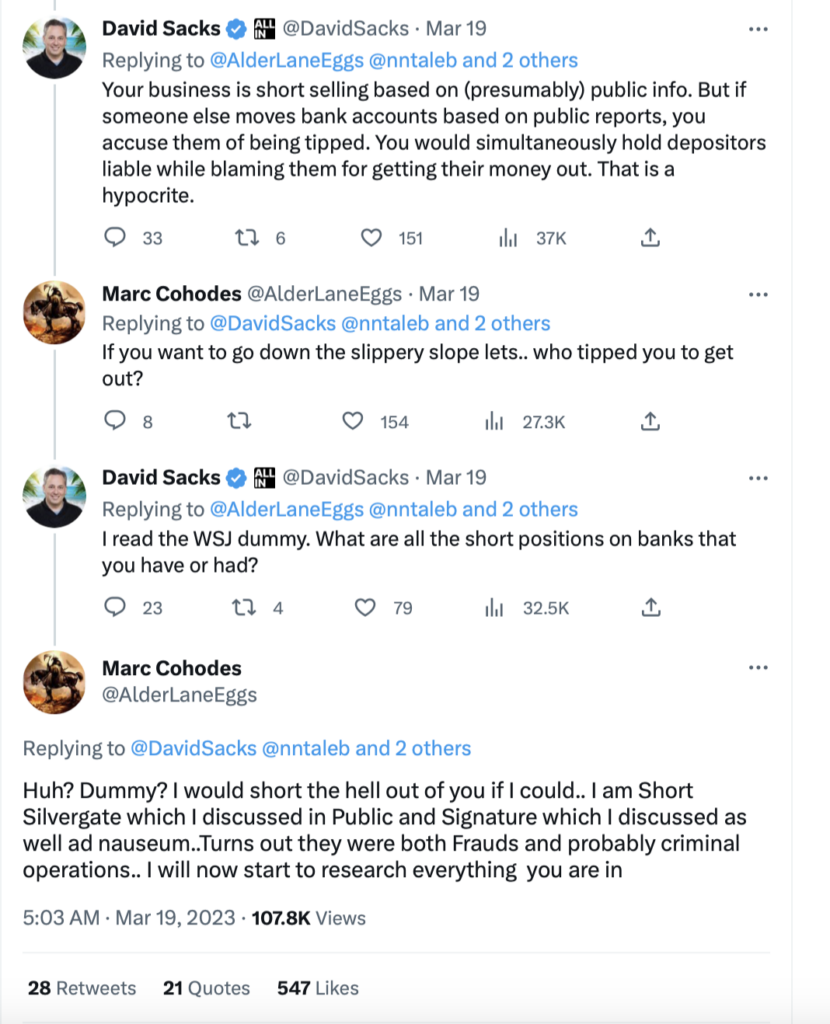

Sacks even tried to answer Cohodes’ question on being tipped, saying he found out about the bank’s unideal liquidity situation on The Wall Street Journal, giving him enough push to “pull out.”

After admitting his short positions in the fallen banks, Cohodes then said he would turn his attention on Sacks.

The public spat

What followed is a bizarre series of back-and-forth tweets–sometimes, ad hominem arguments–between the two online pundits.

You guys epitomize this idiotic contradiction, except that you’re even worse than the media (if that’s possible) because you’re spreading innuendo and making a bunch of unfounded accusations. https://t.co/oZ9sQSHMFn

— David Sacks (@DavidSacks) March 18, 2023

That would explain the giant gaps in your teeth.

— David Sacks (@DavidSacks) March 18, 2023

LOL. Your accusations are becoming more and more unhinged.

— David Sacks (@DavidSacks) March 18, 2023

But Cohodes is not letting up. The short seller is continuing to press Sacks on how he was probably tipped off on the banks’ collapse so he could pull out his money.

The great thing @DavidSacks is all of those Podcasts and Interviews are Evidence.: Who tipped you and did you trade? Cant wait to hear the answers to very simple questions pic.twitter.com/qlAukcQ60d

— Marc Cohodes (@AlderLaneEggs) March 20, 2023

This column doesn’t have any idea what will happen next but we’re surely hanging on to our popcorn.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.