Walmart Adjusts Grim Earnings Outlook Following Strong Q2 2023 Financials

Walmart Inc. (NYSE: WMT) reported Tuesday its financial results for fiscal Q2 2023 ended July 31, 2022. The report highlighted a quarterly revenue of US$152.86 billion, marginally up from Q2 2022’s revenue of US$141.05 billion.

“We’re moving a lot of volume through our business, and I’m proud of how our associate team has responded and serving customers as we manage through this unique period,” said CFO John David Rainey on the earnings call. “We delivered strong top-line growth with total constant currency revenue up more than 9% in the second quarter.” The quarterly revenue also beat the consensus estimate of US$150.81 billion.

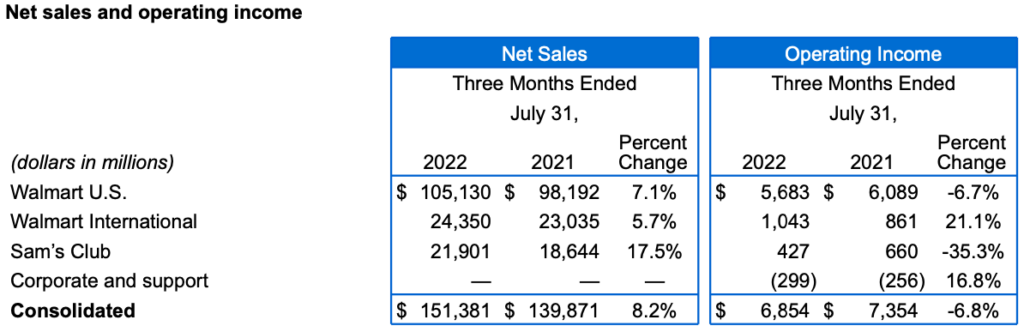

Breaking down the topline revenue figure, Walmart US sales increased to US$105.1 billion from US$98.2 billion last year, while Walmart International sales increased to US$24.4 billion from US$23.0 billion last year. The company’s Sam’s Club also increased to US$21.9 billion from US$18.6 billion last year.

Overall operating income ended at US$6.85 billion, down 6.8% from last year’s US$7.35 billion. The decline was better than the previously announced grim guidance of 13% – 14% decline in Q2 2023’s operating income.

“A few weeks ago, we updated you on our expectations for how we would perform in Q2 and for the year. The second quarter finished stronger than we had anticipated,” said CEO Doug McMillon.

The firm ended with a quarterly net income of US$5.15 billion compared to last year’s net income of US$4.36 billion. This translates to US$1.88 earnings per diluted share.

On adjusted basis, earnings per share ended at US$1.77, a 0.6% decline from the year-ago period. This decline is also far from the initially predicted 8% – 9% decline for the quarter. The figure also beats the estimate of US$1.62 earnings per share.

The company also ended the quarter with US$13.92 billion in cash and cash equivalents and US$59.92 billion in inventory, putting the balance of the current assets at US$84.16 billion. Current liabilities ended at US$99.90 billion.

Following its second quarter performance, the retail chain is walking back a bit from its previously announced income outlook for the rest of the year: consolidated adjusted operating income is now expected to decline 9.0% – 11.0% coming from prior guidance of 11.0% – 13.0%, while adjusted EPS is now expected to fall 9.0% – 11.0% coming from prior guidance of 11.0% – 13.0%. In Q3, the firm expects an 8.0% – 10.0% decline for operating income and 9.0% – 11.0% decline for adjusted EPS.

Canceled orders and high-income consumers

The inventory balance at the end of the quarter is around US$12.28 billion higher than last year’s counterpart–approximately US$11 billion of which is inventory increase in US operations.

“If you decompose [the US inventory increase], about 40% of that is due to inflation. So don’t think units, think just dollars… [We’ve] got less in stock next year and you normalize for all of that, you really whittle that down to about $1.5 billion of inventory that if we can just wave a magic wand, we’d make go away today,” noted McMillon.

“We’ve also canceled billions of dollars in orders to help align inventory levels with expected demand. We estimate that only about 15% of our total inventory growth in Q2 is still above optimal levels,” Rainey added.

McMillon also noted that in Walmart US business, they’ve observed “mid- to higher-income customers come to Walmart looking for value.”

“The quality, value, and convenience we offer make Walmart a smart choice, and we’re seeing more middle and higher-income shoppers choose us,” McMillon explained.

The retailer giant has also observed more pronounced consumer shifts and trade-down activity.

“As an example, instead of deli meats at higher price points, customers are increasing purchases of hotdogs as well as canned tuna or chicken. Private brand penetration has also inflected higher,” he added.

The firm was recently reported to have started downsizing, with about 200 positions up for eliminations.

Walmart last traded at $132.59 on the NYSE, then rose 5% when the market opened.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.