Berkshire Hathaway (NYSE: BRK.A), a conglomerate helmed by Warren Buffett, strengthened its largest shareholder position on Occidental Petroleum (NYSE: OXY) by purchasing an additional 5.99 million shares, bringing its total equity on the oil company at around 20.9%

The purchase–made in multiple transactions from Sept. 26 to Sept 28–follows after acquiring 9.9 million shares in the company in July 2022.

Berkshire also owns 100,000 shares of the oil firm’s series A preferred stock, as well as warrants to purchase roughly 83.9 million shares at an exercise price of US$59.624 per share.

The investment firm also got an approval from the Federal Energy Regulatory Commission to potentially increase its stake up to 50%.

Why is Buffett loading up on oil stocks?

Seeking Alpha‘s Rida Morwa offered reasons why the so-called “Oracle from Omaha” is increasing his stake on an oil firm despite the supposed global shift to renewable energy resources.

“There is no new oil company coming to disrupt existing players. Mr. Buffett has been a seeker of businesses with a tangible competitive advantage and the ability to achieve profitability without spending too much to grow,” he wrote.

He added that while the world is looking at a carbon-neutral energy market, “anyone who thinks oil is history is disconnected from reality.”

“Since the beginning of the war, we see G7 leaders scramble for reliable hydrocarbon supply. Mr. Buffett understands that we will be more dependent on crude oil and natural gas in 2050 than we are today,” he added.

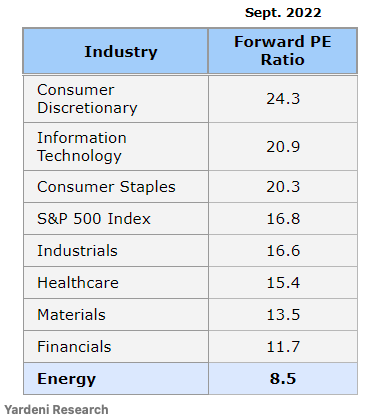

Another reason for increasing the investment firm’s stake in Occidental Petroleum is the cheap valuation of the companies in the energy industry.

“When a tech company has no competition, it typically carries frothy valuations and is touted as a generational buying opportunity. But oil doesn’t enjoy those lofty multiples and is the cheapest industry sector today,” he also noted.

In Q1 of 2022, Berkshire bought about US$7 billion worth of shares, and Buffett mentioned at the company’s annual meeting in May that he was able to purchase 14% of Occidental over just a two-week period. He also noted at the meeting that he felt that Occidental’s CEO was running the company well.

Information for this briefing was found via Seeking Alpha and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.