On August 26, WeCommerce (TSXV: WE) reported its second quarter financial results. The company announced total revenue came in at $9.53 million, up 57.6% sequentially, while SG&A came in at $6.85 million, up 60.4% and putting operating margins at -5.2%, down from the -2.3% in the first quarter. The firm reported earnings per share of -$0.01, while EBITDA came in at $3.2 million, for a 34% EBITDA margin.

WeCommerce only has two analysts covering the stock, with TD having a $22 price target, or an 86% upside. Canaccord meanwhile has a $20 price target. One analyst has a strong buy rating and the other analyst has a buy rating.

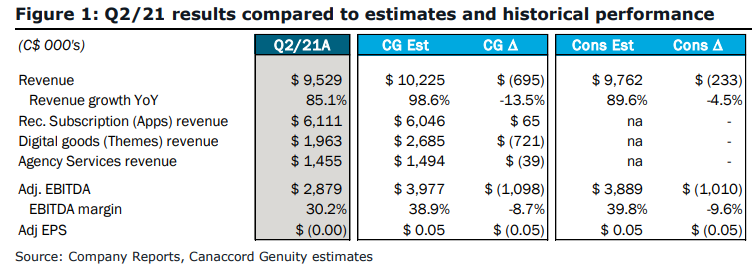

Canaccord Genuity reiterated their $20 12-month price target and buy rating on WeCommerce saying that this quarter shows that the company’s themes are taking a breather but the long-term growth/thesis remains intact. Canaccord forecasted revenue to be $10.22 million for the quarter. The miss came from Canaccord estimating digital goods revenue to be $2.68 million, while it came in at $1.96 million. Adjusted EBITDA came in at $2.87 million, or a 30.2% margin, while Canaccord’s estimates were $3.97 million and 38.9%.

Canaccord says that the company’s app revenue “benefited from the addition of Stamped although FX and a pricing change favoring volume over upfront payment were temporary headwinds.” Service revenue benefited from easier comps due to the second quarter of 2020 being in the middle of the pandemic, while digital goods revenue was missed due to customers pausing decisions in front of an expected change at Shopify Unite. Canaccord believes that this miss will be more temporary in nature than any permanent changes.

Canaccord still sees the company’s M&A opportunity strong, “with $100M+ of revenue and a variety of targets ranging in size and valuation.” The company ended the second quarter with $5.1 million but closed a bought deal after the quarter ended. The company also has a $50 million term loan and $12.5 million in a revolver loan. Canaccord believes that net cash is currently $35 – $40 million.

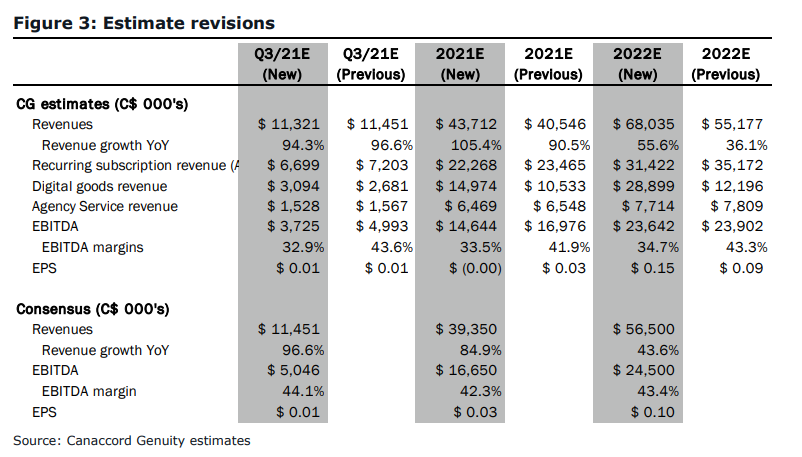

Below you can see Canaccord’s updated third quarter, full year 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.