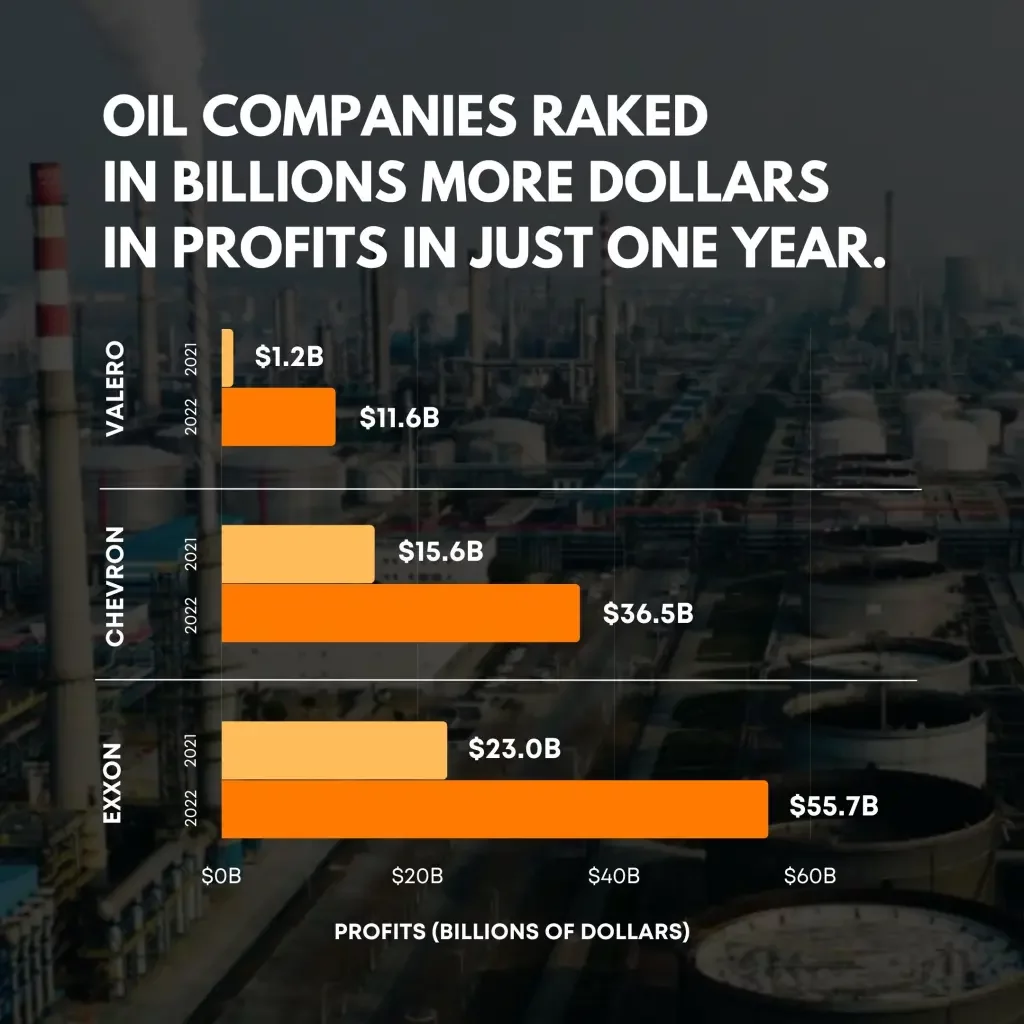

ExxonMobil (NYSE: XOM), one of the world’s largest energy companies, made a staggering $55.7 billion in annual profits in 2022, breaking its previous record of $45 billion set in 2008.

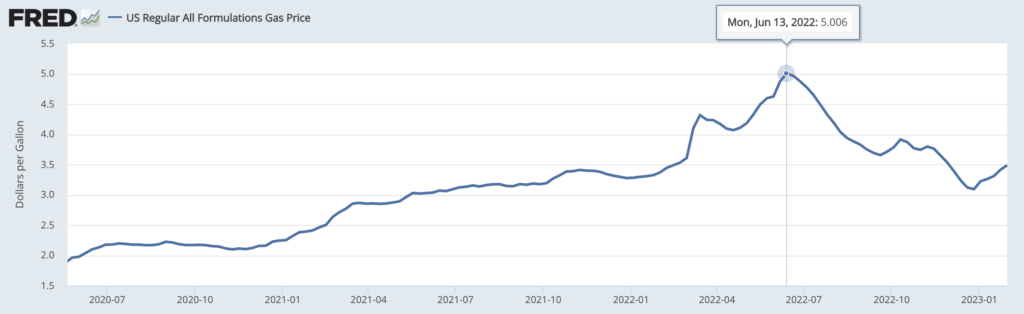

The increase in profits is a result of “favorable market conditions,” according to CEO Darren Woods, and the phrase conjures up a newsreel of the past year’s record-breaking gas prices. And the White House, which has spent a significant portion of 2022 calling out oil and gas companies for profiting from already-suffering Americans, isn’t at all happy about it.

“It’s outrageous that Exxon has posted a new record for Western oil company profits after the American people were forced to pay such high prices at the pump amidst [Russian president Vladimir] Putin’s invasion,” said White House spokesperson Abdullah Hasan.

“The latest earnings reports make clear that oil companies have everything they need, including record profits and thousands of unused but approved permits, to increase production, but they’re instead choosing to plow those profits into padding the pockets of executives and shareholders while House Republicans manufacture excuse after excuse to shield them from any accountability.”

The Biden administration has been calling on oil and gas companies to reinvest their profits to increase oil production to alleviate supply constraints following Russia’s war in Ukraine and lower energy prices.

READ: White House: Oil Companies Have A “Patriotic Duty” To Increase Production

But oil and gas giants have largely ignored the White House, instead accusing it of “vilifying” the oil industry, and blaming president Joe Biden’s policies for keeping gas prices high. Companies like Exxon are celebrating their profits following two years of lows from pandemic-induced low demand for their product.

Chevron (NYSE: CVX) also posted record profits in 2022 at $36.5 billion. The company, in a move criticized by the Biden administration, announced a share buyback program after unveiling its 2022 financials.

READ: Newsom Continues to Blame Big Oil for High Gas Prices in California, Critics Disagree

The country’s biggest oil and gas companies generated an estimated total of $190 billion in profits in 2022, according to a report by CNBC citing Refinitiv analysts.

Biden has threatened to impose a windfall tax on oil companies’ surplus profits if they choose not to repatriate profits. The windfall tax would follow in the footsteps of the EU with its 33% windfall tax and the UK’s 25% energy profits levy. But a windfall tax is unlikely to get support in the Republican-dominated Congress.

Information for this briefing was found via ExxonMobil, BBC, Reuters, CNBC, and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.