Mobileye Global Inc., Intel’s (Nasdaq: INTC) self-driving technology company, is aiming for a public offering valuation of around $16 billion, significantly lower than its earlier objective in the midst of a difficult year for new listings.

According to a statement with the US Securities and Exchange Commission on Tuesday, the company intends to sell 41 million shares for $18 to $20 each, raising $820 million. Intel will retain a majority stake in Mobileye following the offering.

However, said valuation is a significant reduction from the $50 billion value that was previously floated, and is less than half of the $30 billion that was being considered just a month ago.

The $16-billion valuation is also just a smidge higher than the $15.3-billion price tag from when Intel bought and delisted the company.

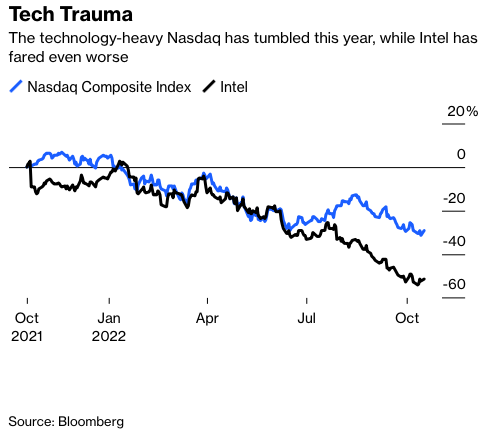

The IPO is also coming at a disadvantageous time for tech stocks, with the Nasdaq Composite having lost a third of its value. Public offering volume has also dropped by more than 90%, and the majority of last year’s IPO crop is now in the red.

Despite the discounted valuation, the IPO is expected to be one of the largest of the year. Despite the terrible market timing, several analysts believe Intel should proceed with the offering. Bernstein analysts believe Intel will need the money from the transaction “given the way their own business is currently trending.”

Vital Knowledge analysts also said the “headline is negative, but keep in mind the $50-billion valuation was floated back in December, so no one should be shocked that the number is now lower today.”

Mobileye will use the net proceeds to fund operating capital and general corporate objectives, as well as repaying a portion of its debt to Intel.

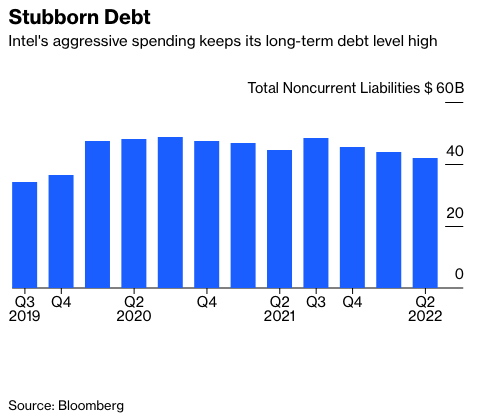

The chipmaker parent firm also has debt issues on top of this.

To keep up with competitors, the corporation has pledged to spending historic sums of money, including $23 billion this year alone, to create new chip facilities.

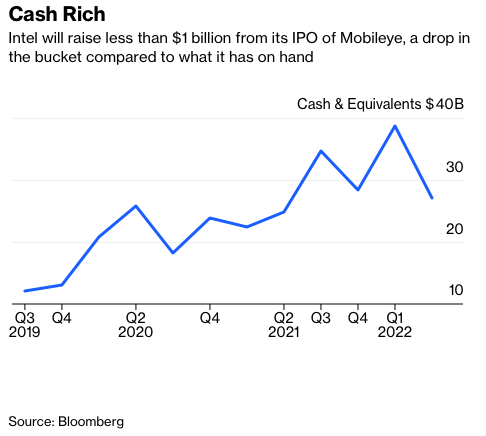

CEO Pat Gelsinger has already stated that Intel does not require the funds raised by the IPO, which is a good thing given the issuance of a 5.8% stake will raise approximately $800 to $900 million — roughly two weeks of capital expenditure.

So why the IPO?

Among the reasons for moving forward include raising the company’s profile and getting additional business. That’s an odd explanation given by the form that Intel is flush with cash and spends $1 billion every year on advertising, which is nearly as much as Mobileye generates in revenue.

Another justification for allowing is to provide Mobileye investors with an upside – take a risk now, and you’ll be well rewarded when the market recovers. However, it’s worth noting that, while Mobileye is selling 46 million class A shares, Intel is keeping all of its Class B shares, which equals to 99.4% of common stock voting power and 94.2% of total shares.

The offering is led by Goldman Sachs Group Inc. and Morgan Stanley. Mobileye intends to list its shares on Nasdaq under the name MBLY, the same ticker it used when it first went public in 2014.

Intel last traded at US$26.48 on the Nasdaq.

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.