Oil futures are on track to reach the lowest prices on record since the start of the year as China’s pandemic lockdown policies and OPEC+ production mandate teeter the already volatile market.

Brent benchmark fell below the $85/bbl mark while WTI fell below the $80/bbl mark, paring the low levels reached two months ago at $81/bbl and $76/bbl, respectively. Current prices are a few dollars shy of the lowest year-to-date records at the start of 2022 at $78.57/bbl and $75.85/bbl, respectively.

Last month, OPEC+ announced a 2 million barrel-per-day reduction in output, and additional cutbacks may be considered this time. Meanwhile, EU leaders failed to reach an agreement on Monday on the Russian price cap, which is set to take effect on December 5th. Both the G7 and the European Union have discussed a cap of between $65 and $70 per barrel, although some countries, such as Poland, believe the cap should be lower.

To bring Brent prices above $90/b and keep them there in the first quarter, OPEC+ has to cut ACTUAL production by an additional 800 kbd.

— Anas Alhajji (@anasalhajji) November 25, 2022

Of course, this is based on several assumptions including continued China lockdowns and no recession in Q1 in Europe & US + more. #Oil #OOTT pic.twitter.com/gpf7fnbS0k

But oil futures went up on Tuesday fueled by hopes that China will soon relax some of its COVID restrictions, boosting oil demand. Simultaneously, rumors that OPEC+ may agree on another output cut at its December 4th meeting pushed up oil prices.

READ: The Anti-OPEC Movement May Do More Harm Than Good, Says OilPrice.com

The Stock-Price Disconnect

The downward trend for oil futures, however, seem to go against the rise of oil stock indexes. The Dow Jones index for US oil & gas is at its record high for the year, closing at a hairline below 7,000 basis points on Monday.

In a Twitter thread, user @TheShortBear illustrated how the oil stock performance has gradually been disconnected from the oil prices. The prices crashing was heavily affected by the consumer price index bottoming. If previous movements would be observed, oil prices tend to bottom out alongside the CPI.

1990s illustrate the idea that there is no clear connection between oil stock performance(here index of major oil stocks) and the oil price. pic.twitter.com/kZ0bRJd9f2

— THE SHORT BEAR (@TheShortBear) November 28, 2022

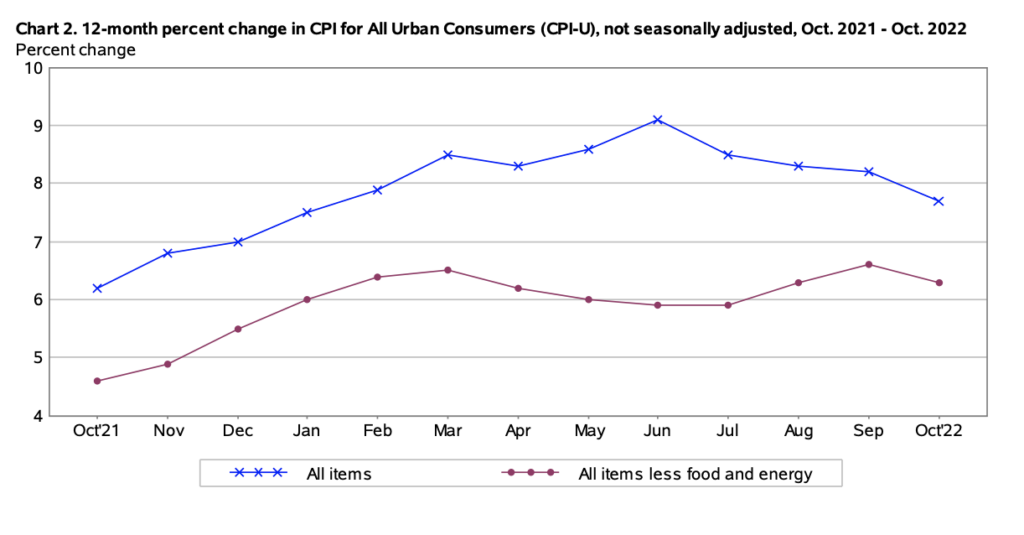

Latest data from the BLS shows headline CPI cooled from September’s annualized 8.2% to 7.7%, marking the lowest print since January 2022 and slightly below the 7.9% consensus forecast by economists. Core CPI, meanwhile, jumped for the 29th consecutive month, rising 6.3% year-over-year, but is nonetheless finally below 40 year-highs and lower than the estimates of 6.5%.

“The focus nowadays needs to be on the oil company plan… the focus is on returning earnings to shareholders (dividends, buybacks). The oil sector has changed drastically,” the Twitter user added.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.