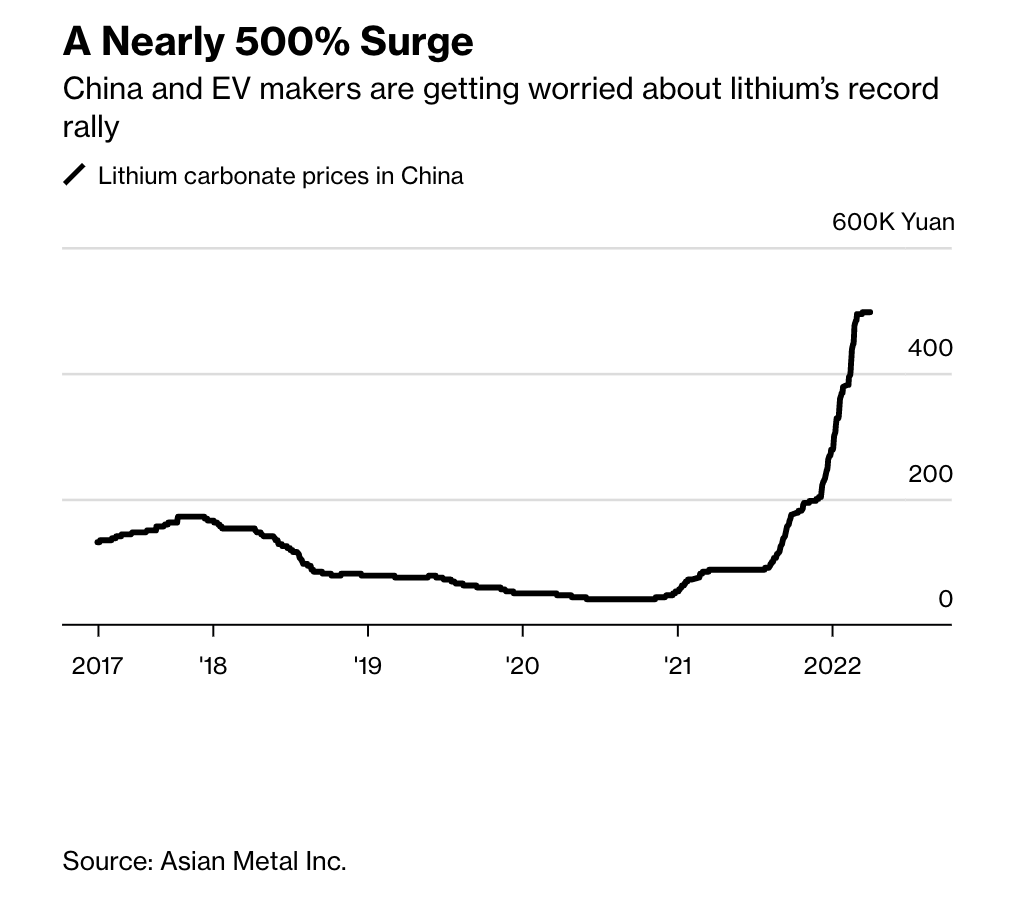

China, the biggest market for electric vehicles, is losing sleep over the surging price of lithium, a key component of electric car batteries. According to Asian Metal Incorporation, the price of lithium carbonate is up almost 475% from June 2021 to March, while an index of global lithium prices compiled by Benchmark Mineral Intelligence skyrocketed nearly 490% over the past 12 months.

The sharp jump in lithium prices prompted China’s Ministry of Industry and Information Technology to conduct a series of discussions with raw material suppliers, industry groups, and battery manufacturers in an effort to tame runaway prices by addressing supply bottlenecks and pricing mechanisms. Although similar government mediation has proven to be successful for other commodities such as steel and coal, it has never been a priority in the EV sector until now. “The industry is facing a very strong headwind from cost escalation,” said Xpeng Inc president Brian Gu, as cited by Bloomberg.

Beijing’s concerns over rising lithium prices is even causing Elon Musk to lose sleep; the Tesla (NASDAQ: TSLA) CEO is now mulling bringing his EV company into the lithium mining and refining business to help abate otherwise surging costs. “There is no shortage of the element itself, as lithium is almost everywhere on Earth, but pace of extraction/refinement is slow,” he tweeted in frustration, citing average lithium prices over the past two decades.

Price of lithium has gone to insane levels! Tesla might actually have to get into the mining & refining directly at scale, unless costs improve.

— Elon Musk (@elonmusk) April 8, 2022

There is no shortage of the element itself, as lithium is almost everywhere on Earth, but pace of extraction/refinement is slow.

But, as we all know, this isn’t the first time high lithium prices have spooked the CEO. Musk, on numerous occasions, teased the idea of developing his own lithium extraction in order to make Tesla more vertically integrated. Back in 2020, the entrepreneur acquired mineral rights in Nevada to mine the commodity himself, after a deal to buy lithium extraction company Cypress Development Corp (TSXV: CYP) fell through.

Although there is an abundance of lithium deposits in the US, extracting the metal from clay has thus far been both too costly and challenging. No company has been able to produce bulk quantities of lithium from clay deposits, but Musk assured investors during his September 2020 “Battery Day” event that the 10,000 acres of lithium-rich clay deposits in Nevada will eventually bring the manufacturing cost of an EV down to $25,000.

Two years later we have yet to see Musk deliver on the ambitious price point, let alone Tesla’s own lithium supplies. But hey, here’s to wishful thinking!

Information for this briefing was found via Twitter and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.