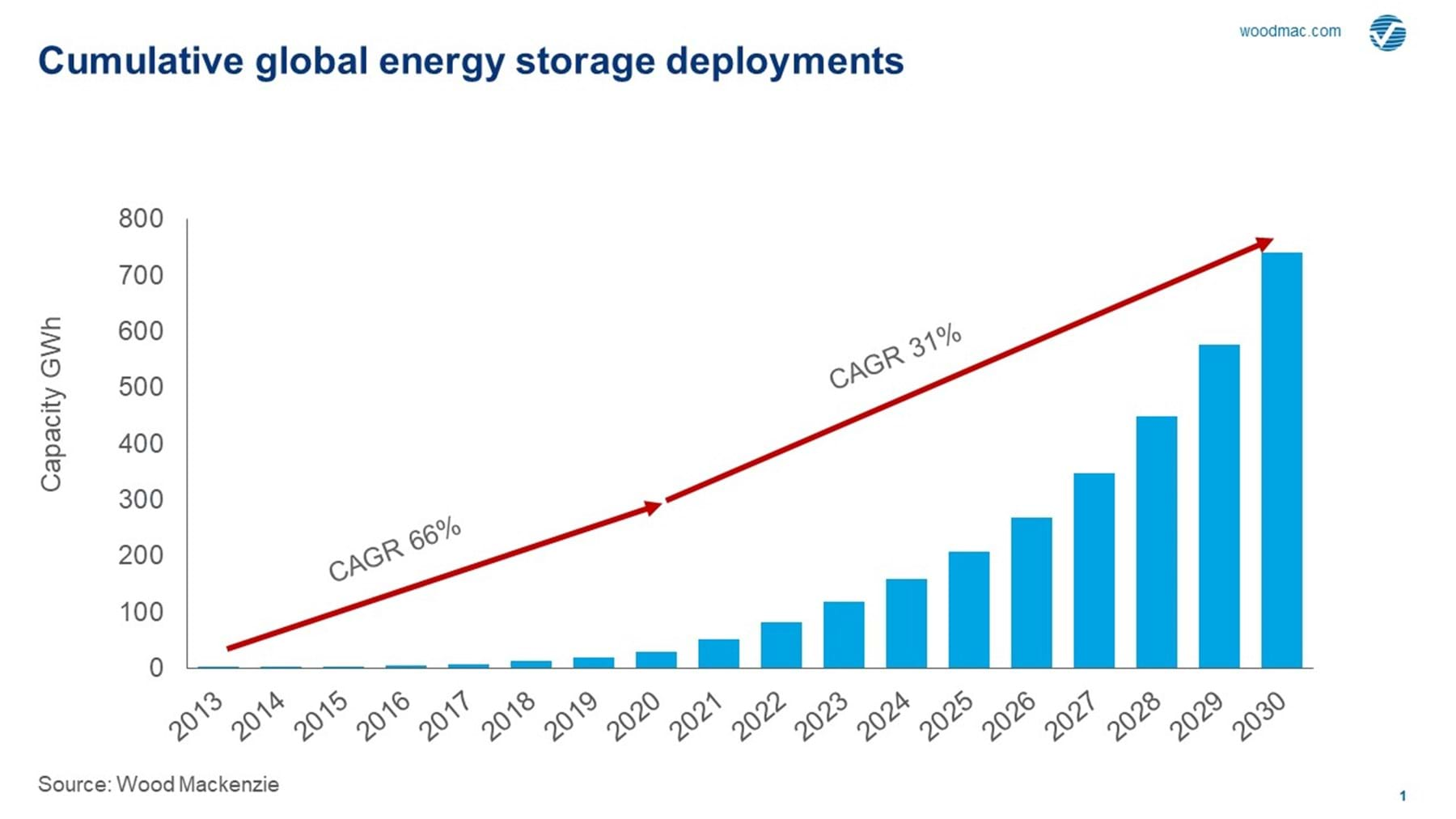

Last week, Wood Mackenize issued a report forecasting the growth of global energy storage capacity. The report estimates that storage capacity could grow to 741 GWh of cumulative capacity by 2030; an annual growth rate of 31%.

Wood Mackenzie predicts that front-of-the-meter installations will account for up to 70% of annual capacity additions through the end of the decade. The research firm’s principal analyst Rory McCarthy states:

“We note a 17% decrease in deployments in 2020, 2 GWh less than our pre-coronavirus outlook. We expect wavering growth in the early 2020s, but growth will likely accelerate in the late 2020s, to enable increased variable renewable penetration and the power market transition.”

On the subject of the investment climate of energy storage, he believes the general momentum of the industry will not slow down as a result of the pandemic. McCarthy adds, “Investment decisions are likely to be pushed back in some cases, but the general trajectory of the power market transition and the need for energy storage to enable this has not changed.“

A recent interview conducted by the Deep Dive with Eguana Technologies (TSXV: EGT) CEO Justin Holland demonstrated similar sentiment. The Alberta based manufacturer of both residential and commercial energy storage systems sees strong growth in the near term.

Wood Mackenzie forecasts the United States will make up 49% of the world’s energy storage capacity by 2030. They predict China will come in second after the US, accounting for 21% of global cumulative capacity by the end of the decade. Lastly, the report forecasts Europe will grow slower than its global counterparts, with the UK and Germany leading the front-of-the-meter installation market until 2025.

The full report can be purchased for US$3,990 at the Wood Mackenzie website.

Information for this briefing was found via the Wood Mackenzie. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.