On April 12th, Xebec Adsorption (TSX: XBC) announced that it received a US$113.5 million order from an Iowa-based company called SCS Carbon Removal. This comes after the company signed an MOU on March 28 for 51 carbon dioxide reciprocating compression packages.

A number of analysts raised their 12-month price target on Xebec Adsorption, bringing the average 12-month price target of C$3.06, which represents a 28% upside to the current stock price. There are currently 13 analysts covering the stock, with 7 analysts having buy ratings, 5 having hold ratings and a single analyst has a sell rating. The street high sits at C$6 which represents a 150% upside to the current stock price.

In Canaccord’s note on the announcement, they reiterated their hold rating and raised their 12-month price target from C$2.25 to C$2.50. They say that “Xebec is well-positioned to benefit from the increased demand for renewable gases that we see evolving from the energy transition.”

They add that this potential growth was evident in management’s recent three-year plan, though they caution investors and tell them that they should stay on the sidelines until they see signs of improved execution. The primary focus on this end is input cost inflation and logistical issues that are “likely to weigh on Q1/2022.”

On the finalized order, Canaccord says that this win “provides great visibility for 2023, but the target of reaching $300- $350 million in revenues in 2024 continues to look ambitious.” They comment that to hit the company’s guidance, Xebec would need to see an increase in orders for their biostream, which is fairly new to the market. While they also see execution risk in delivering all 51 carbon capture packages as it’s such a new product.

Nonetheless, Canaccord says that the large order, “establishes Xebec as a player in the carbon capture & sequestration market, which has a TAM of US$27 billion, according to management.”

Lastly, Canaccord says that the company has almost $100 million in liquidity to support its operations, which comes in the form of $40 million in cash and $58 million in undrawn credit facilities.

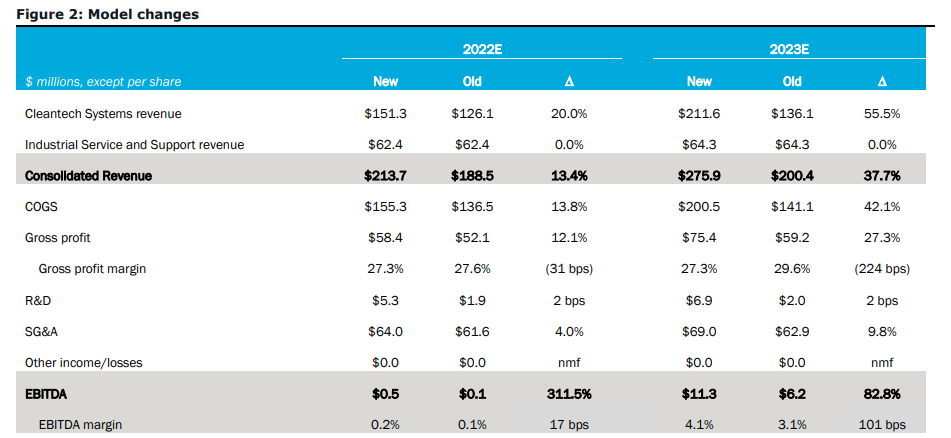

Below you can see Canaccord’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.