Chinese President Xi Jinping’s government is not at all pleased about CK Hutchison‘s planned $23 billion ports sale to a US-led consortium, signaling Beijing’s displeasure with the Hong Kong conglomerate’s decision to transfer strategic assets to American control.

State authorities reposted newspaper commentaries labeling the deal a betrayal of Chinese interests, an unusual public rebuke of the powerful Li family that controls CK Hutchison. The articles, published in state-backed Ta Kung Pao, called the transaction a surrender to “ill-intentioned US forces.”

The Hong Kong and Macau Affairs Office in Beijing reposted a Ta Kung Po article on its website, criticizing CK Hutchinson’s Panama Canal deal with BlackRock, citing the sale as a “betrayal of all Chinese people”https://t.co/H4W9ojntxC

— Joel Chan (@kjoules) March 14, 2025

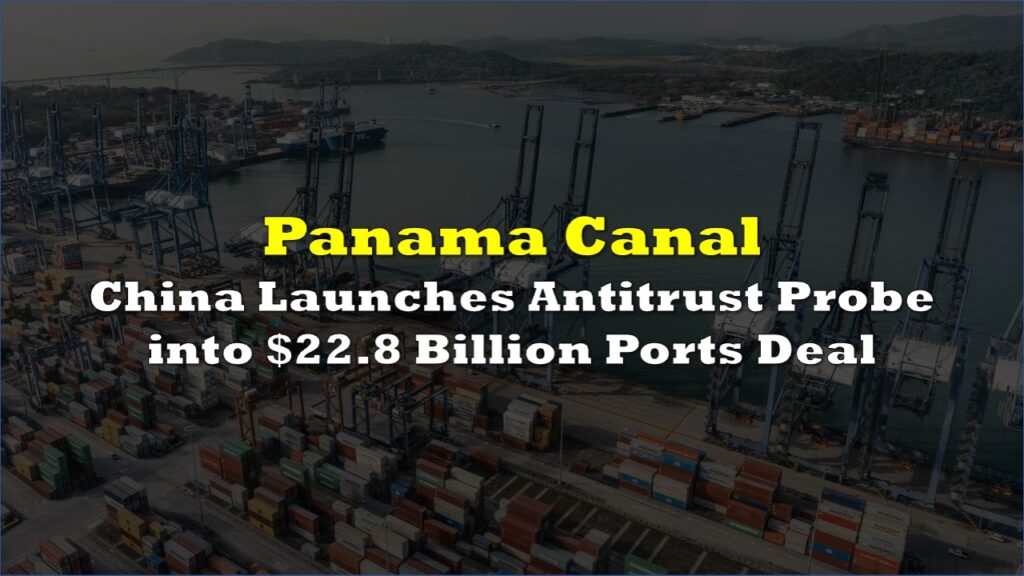

CK Hutchison Chair Victor Li announced the preliminary agreement on March 4 to sell an 80% stake in 43 ports across 23 countries while attending China’s annual legislative session in Beijing as a key adviser to the government. The timing couldn’t have been worse.

Read: BlackRock Leads $22.8 Billion Takeover of Panama Canal Ports

The sale comes after President Donald Trump claimed without evidence that China “operates” the Panama Canal, where CK Hutchison maintains facilities that would transfer to BlackRock‘s control under the deal.

Xi’s government possesses significant indirect leverage over the Li family’s extensive business interests despite lacking direct regulatory authority to block the transaction, which excludes ports in China and Hong Kong.

While Beijing lacks direct regulatory authority to block the transaction, they could apply pressure by introducing complications in contract renewals for ports and electricity infrastructure in Hong Kong. As Reuters points out, this would be similar to tactics previously applied to other prominent business figures, including Alibaba founder Jack Ma.

Read: Trump’s Panama Canal Strategy Unlikely to Include Military Invasion, Officials Say

The Chinese leadership views shipping infrastructure as strategically crucial in its economic competition with the United States. By publicly signaling anger, Xi’s administration elevates what was intended as a corporate transaction into a potential diplomatic issue.

The BlackRock-led consortium, which includes Global Infrastructure Partners and Terminal Investment, would gain control of ports in Panama and 22 other countries through the $22.8 billion deal including debt.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.