Zenabis Global (TSX: ZENA) has further pushed out certain of its debts, keeping in line with its recent trend. Rather than pay down $6.4 million in principal that was due October 17, 2020, the company has managed to push off the debt yet again.

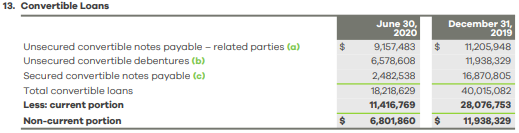

The debt in question that has been renegotiated yet again appears to be the unsecured convertible notes issued on October 17, 2018. At the time, the notes were issued as a means of refinancing certain shareholder loans that were outstanding at the time. The cost of capital for this debt has continued to climb as Zenabis continuously renegotiates the maturity date on the debt.

The debt was to initially maturity in October 2019, which was delayed in January 2019 as the company came to realize it would not be able to cover the debt payment. It was then renegotiated with a lower conversion rate in November following the rights issuance conducted by the company, with that exchange rate having fallen to $1.91 per share.

Then again in May 2020 some of the debt was renegotiated, with a portion being exchanged at $0.07 per share, and another portion seeing the maturity date extended to June 2022.

Now, $6.4 million in principal that was due to be paid out by the 17th has been delayed until June 30, 2021. In exchange for this, 1,237,500 common share purchase warrants with an exercie price of $0.15 has been issued to the noteholders. The warrants have an expiry of five years from the date of issue.

Further, a final noteholder who owns $2.6 million in principal of this October 17, 2020 debt has issued an interim waiver of any default to enable further negotiations to occur for the extension or settlement of the debt – meaning it appears that Zenabis is simply unable to pay its debts. All of the principal due October 17 as a result has been delayed or renegotiated at this time.

Zenabis Global last traded at $0.055 on the TSX.

Information for this briefing was found via Sedar and Zenabis Global Inc. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

8 Responses

And why did they deleted their Instagram account? That’s weird

The terms compared to previous loans are very favorable to Zena. It makes complete sense to extend when the selling of Delta is still ongoing and they need to cover 7.5 million in December. These note holders are from the very beginning and clearly long on Zena. A short maturity protects the note holders and benefits Zena as they get a chance to grow or find favorable financing.

Hi,

I would be worried about the continuous rise in inventory instead of increasing the numbers pushing the global market. Here’s a significant lag why I questions the numbers given. Besides that EBITDA isn’t quite a reliable number you should trust since it doesn’t take into account DA, which in this case is quite important in terms of overall profitability. Everybody is hoping that demand will increase rapidly. This will only be the case in the medical sector, which is a small market of the total addressable market.

Jay, you have a very clear negative bias on your Zenabis coverage. The terms compared to previous loans are very favorable to Zena. It makes complete sense to extend when the selling of Delta is still ongoing and they need to cover 7.5 million in December. These note holders are from the very beginning and clearly long on Zena. A short maturity protects the note holders as they give Zena a chance to grow.

This is now the what, fourth? time they’ve renegotiated this debt? That’s not a good look no matter what way you want to cut things.

Last quarter Zenabis posted $8.8 million in gross profits before fair value adjustments. In the same time frame, they posted interest expenses of $8.0 million. The company is drowning in its debt. Pushing it off at the expense of shareholders (through continuous issuances of warrants as an incentive to delay the debt) is not a positive.

How is the company going to service its debt, when profits on a gross basis can hardly cover the interest that is being collected on that debt, which doesn’t even factor in the actual operating expenses of running the operation?

Zenabis needs to settle its debt for good. Not continue to delay it.

Jay, you’re misleading people about a few things.

The 8 million in interest paid last quarter was due in large part to the one time early penalties from the substantial amount of debt they paid off in Q2. Please look at the latest investor presentation. On going interest for the Cannabis portion is 2.35 million a quarter and 2.7 in total including prop. (Page 17)

On the same note, did you know the total Cannabis debt still owed is 76.6 million? 50 million of that is to be paid back amortized over 36 months starting mid 2022. That’s manageable. The prop side has the 43.3 mil loan from BMO at a floating rate.

Guidance as recent as two weeks left in Q3 also tells us that Cannabis revenue is increasing from 11.8 mil to 17-21 or possibly even exceed that for Q3.

Zena expects to have edibles launching in Q4.

On top of that Zena has the already profitable propagation business.

Finally, I guess we can agree to disagree on these notes. These notes were loans from original shareholders. It’s not the same as borrowing from RCMorris or MMCAP who hold the rest of the debt. I admit the RCMorris terms are awful. Hopefully Zena can pay it off sooner.

Hi all,

They won’t sell Dell before December. So they will renegotiate the debt in December again hoping that they will be profitable in the upcoming two years. However the Covid virus pushed them back in supply in Q3, so I would take a run for your money while you still can even though it’s a small fraction of the original amount invested. If it’s too good to be true it’s most likely too good to be true. So stop hoping you will get your money back. take a run an reinvest. The legal cannabis industry has lost against the illegal industry which is rising due to Covid while this should have been the trigger for rise of the legal industries.

With the cash they’ve saved from the raise, and by pushing the October debt, they should have the ability to pay December if Delta does not sell and if they cannot secure any further cash.

People love to point out the risk but you’re not buying a billion dollar company. We’re at 40 mil market cap (the second lowest of the Tier 2 companies) with numbers all the other Tier 2s dream of.

Bart, which other cannabis company is posting 17 mil + cannabis quarters, with positive EBITDA and has a profitable side prop business with a market cap anywhere near ours.