“If my calculations are correct, when this baby hits 88 miles per hour, you’re gonna see some serious shit.” – Dr. Emmett Brown from Back to the Future.

Today we are going to hop in our Delorean and travel into the future to see what will happen with some of the stocks we are holding or looking to add. Okay, we are not actually going to time travel but we can use our imagination and pretend we are. We will go over some useful insight that can be helpful in understanding how that stock you have been eyeing might move next.

“We’re sending you back to the future!” Let’s apply a simple, but all to often forgotten common sense approach to helping ourselves find ways to predict the future.. at least until we can get the Delorean up and running again that is.

Chances are that you have a stock in mind that you are interested in that can be linked or tied into a futures exchange. What do I mean by that? Well perhaps the company you are looking to invest in mines bitcoin, or perhaps the the company produces oil, or maybe mines for copper. Regardless of the specifics all these companies have something in common. You can trace the likelihood of their prices to the futures of which drives their business.

Utilizing the futures

So for example, if you were investing in Kinross Gold Corp then you could take a look at how gold is currently priced. You could even consider some analysts or chartists price projections for the direction it may go next. Prices are not always completely correlated due to company specifics. However this should be of consideration and can help you feel at ease when considering the company you are invested in, if you have a better grasp of the bigger picture for the sector in which the company is in.

Okay, let’s be honest here. We are not really looking into the future per se, but the company you are investing in is dependent on the prices of this future. For example: You may have noticed that a lot of cryptocurrency companies started to decline rather aggressively in conjunction with the price of bitcoin and other cryptos falling off their recent highs.

There will be exceptions to these price movements of course. Some companies might have better or worse fundamentals which will exaggerate the stock’s price movements in comparison to its peers. And there is always news that can shock the markets and make a company move in an opposite direction to which the futures are moving. You need to be mindful of this. I am implying we can look into the future yes, but really there is no crystal ball per se. It is good to have some broader perspective and this should help you moving forward.

What if there is no future?

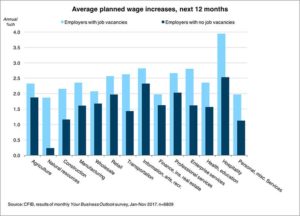

What if my company manufactures recreational vehicles? Good question. I am not aware of any dirt bike futures exchange.. although, that would be pretty cool. Regardless, there are other ways to tackle this and to look into the future of these companies. With recreational vehicles for example we could look at household discrescrecainry income for starters. Is that increasing or decreasing?

If we were bullish on this market niche then we would want this to show a trend of increasing discrescrecainry income, because if income begins to get tight for households we know things like paying for the lights to stay on will trump buying that new dirt bike you wanted. Well maybe this is not true for all people, but you get the point.

It is wise to take a step back periodically and look at the bigger picture and what is happening there. Ultimately this will be a driving force for the company in which you are invested in. Yes it is good to know what is happening within the company. But with the bigger picture in mind as to what is happening to the futures that impact the company, you will be better informed and more knowledgeable as to when buying and selling opportunities exist.

Of course, this is not a blanket statement. Companies can perform poorly when the futures are ripping or vice versa. Looking at the futures can be beneficial to you when you combine this with your other indicators and research on the company you are investing in or considering for an investment.

Moral of the story: Find out what drives the company you are invested in. Plan a way to keep track of how that segment is performing whether it be via the futures exchange itself or factors within our economy. Keep this in mind before you zoom into the company specifics and where you envision this stock moving next.

Image sourced via Macleans article, “The 91 most important economic charts to watch in 2018”, sourced February 18. http://www.macleans.ca/economy/economicanalysis/the-most-important-economic-charts-to-watch-in-2018/