Although there are some indicators that the US economy is beginning to show initial signs of a rebound, such as the easing of restrictions re-opening of non-essential businesses and services, many Americans are still struggling to meet the financial needs of their basic necessities.

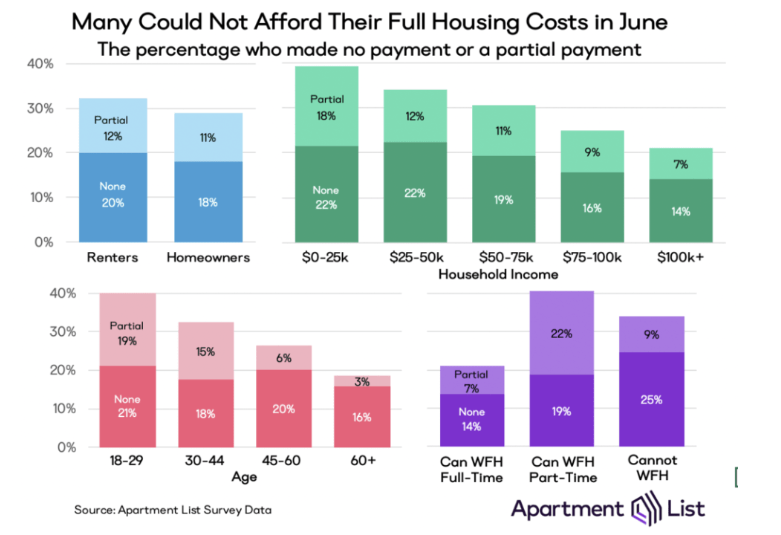

According to a recent survey conducted by Apartment List, a total of 30% Americans were unable to meet their housing payment obligations for the month of June, with one third only making a partial payment, and the remainder making no payment at all. Housing payments have been predominantly delinquent among households that make under $25,000 annually (40%), those that rent (32%), adults under the age of 30 (40%), as well as those that live in urban areas (35%). Meanwhile, missed payment rates among mortgaged homeowners are as high as 29%.

Although many households across the US have missed their payments at the beginning of the month, some are playing catch-up at a later date throughout the month. The start of May saw missed payment rates as high as 31%, but by the end of the month the delinquency rates were down to only 11%. however, given the current trajectory of missing or delayed housing payments, it is not likely the coming months will show any sudden, significant improvement.

Information for this briefing was found via Apartment List. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.