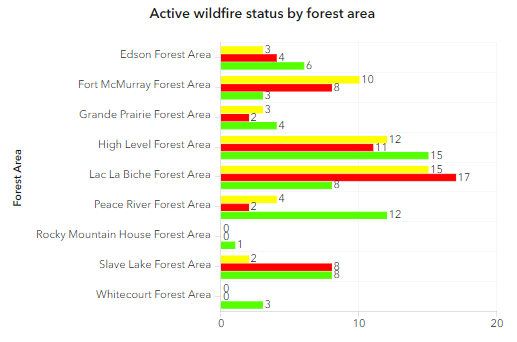

Alberta is seeing a surge of new wildfires, posing serious a threat to the region’s oil production. The fires, many of which are burning south of Fort McMurray, could potentially impact facilities producing over 400,000 barrels of oil daily.

Several major oil sites are at risk, including MEG Energy Corp‘s (TSX: MEG) Christina Lake site, Imperial Oil Ltd’s (TSX: IMO) Cold Lake site, and Canadian Natural Resources‘ (TSX: CNQ) Kirby oil sands. These facilities are all within close proximity to active blazes.

This latest outbreak follows previous wildfire-related disruptions in the area, which forced a partial evacuation of Fort McMurray in May. The situation has worsened due to hot weather conditions, with over 50 out-of-control fires currently burning across the province.

“Our first priority is the safety and well-being of our people and the communities near our operations. We are proud of our team’s resilience and dedication during this challenging time. By maintaining a proactive approach to safety and reducing our on-site workforce to essential personnel only, we have been able to safeguard our operations,” commented Darlene Gates, CEO of Meg Energy, in a release issued late last night indicating that production remains stable at their Christina Lake operation. The company however has reduced staff on site to only essential workers.

The impact on oil production is already evident. Suncor Energy Inc. (TSX: SU) has reduced output at its Firebag site, while Cenovus Energy Inc. (TSX: CVE) has removed some workers from its Sunrise facility.

Greenfire Resources Ltd. (TSX: GFR) temporarily halted production at its Hangingstone sites, and Imperial Oil has begun evacuating non-essential personnel from its Kearl oil sands mine.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.