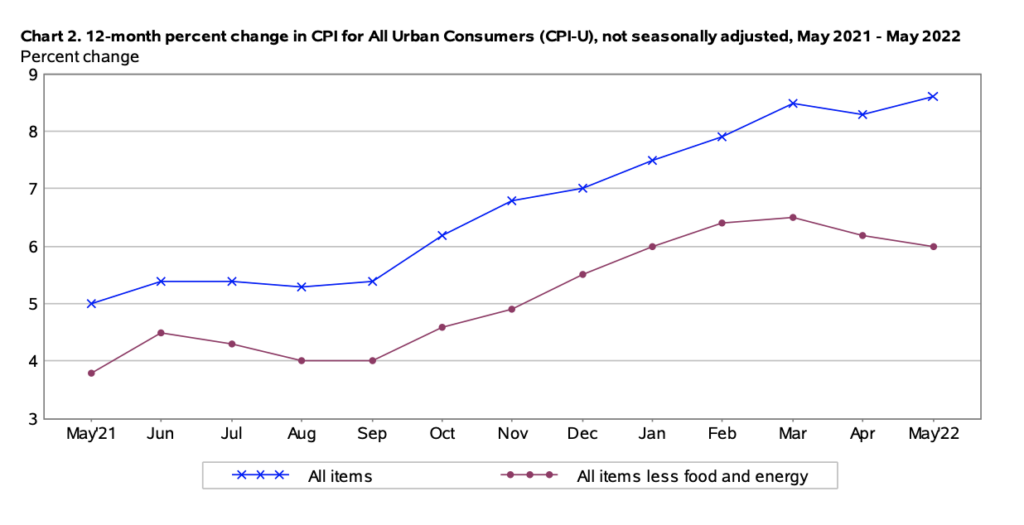

In an attempt to preserve its rapidly-plummeting credibility, the Fed hiked rates by a shocking 75 basis points, as inflation continues to spiral out of control to no avail.

Following the completion of the FOMC’s two-day meeting, the Fed decided to raise its overnight rate to 1.75%, signalling it is “strongly committed” to tackling inflation. The last time borrowing costs were hiked 75 basis points was 1994, suggesting that the Fed is embarking on a much-needed damage control after failing to abandon its transitory narrative even when everyone else and their dog realized that rapidly-accelerating consumer prices were here to stay.

The last time the central bank raised rates by that much resulted in the IMF having to bail out Mexico after the peso dramatically devalued against the US dollar. The (largely expected) bloodbath has thus far sent Treasury yields soaring, gold plummeting, and the spread between the 2-year and 10-year to 0.13.

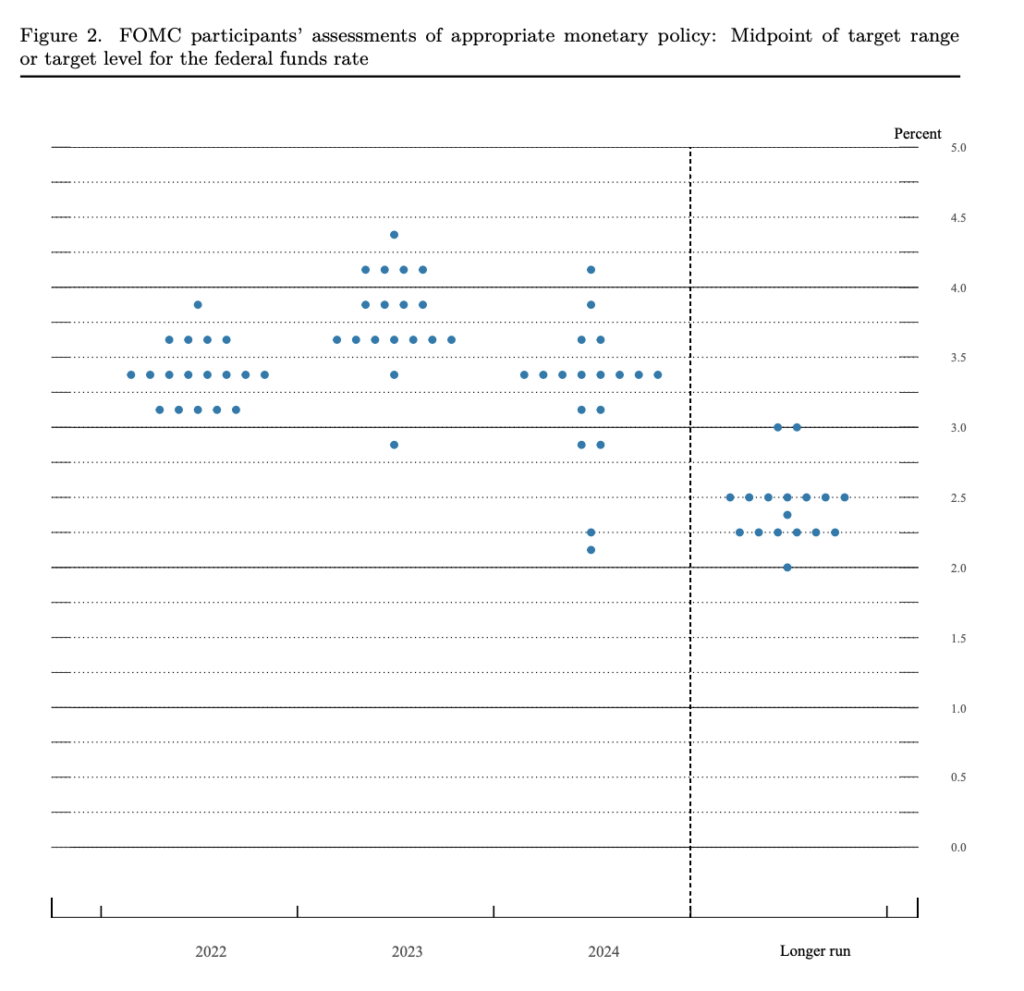

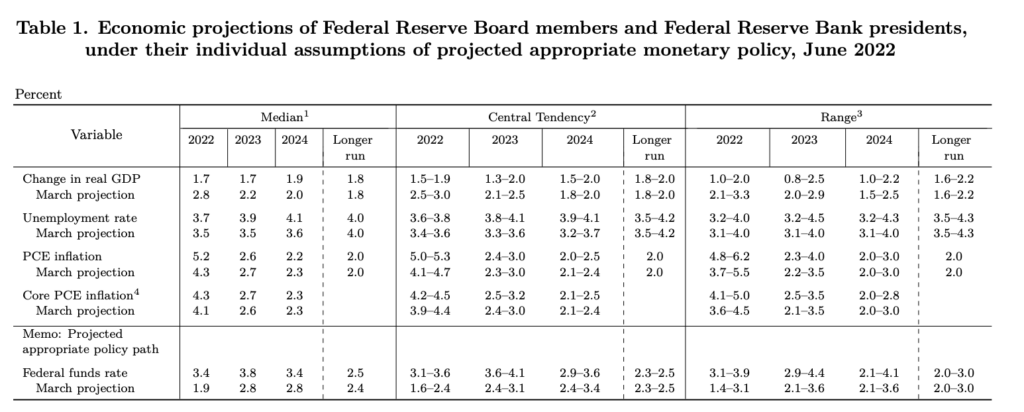

But, the most dramatic outcome of the FOMC meeting were members’ projections on the forthcoming state of the US economy, where growth and employment outlooks were significantly lowered. The infamous dot-plot sharply increased from the March meeting, with expectations of the federal funds target rate increasing by 175 basis points to 3.4% before the end of the year, followed by 3.8% in 2023 and 3.4% the following year. That is compared to previous forecasts calling for a rate of 1.9% in the current year, and 2.8% for both 2023 and 2024.

The Fed now projects that America’s economy will only grow by 1.7% in 2022 and 2023, compared to previously ambitious forecasts calling for an expansion of 2.8% and 2.2%, respectively. while the unemployment rate rises from 3.7% in 2022 to 4.1% come 2024. So much for a soft landing.

Information for this briefing was found via the Federal Reserve and CNBC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.