Recently Activision Blizzard (NASDAQ: ATVI) reported its first quarter financial results. The company reported revenues of $1.77 billion, down from $2.27 billion last year for the same period. Activision also saw its gross profit drop from $1.7 billion down to $1.3 billion this quarter. Its gross margin percent dropped to just under 73% for the quarter.

Operating margin meanwhile took a massive hit, going from 35% of revenue down to 27%, mainly on the fact that gross profits were less than a year ago. SG&A expenses dropped from $549 million to $464 million, but was not enough to make up for the gross profit shortfall.

The company also reported its monthly active users were down to 372 million, and their in-game net bookings were $1.01 billion, down from $1.34 billion a year ago. Finally, Activision indicated that the transaction with Microsoft is on track and expected to close in Microsoft’s fiscal year ending June 30, 2023.

In BMO Capital Market’s note on the results, they say that they find them disappointing, as this is the second consecutive quarter the company has reported worse than expected earnings. They write, “Title performance was lackluster across the board.”

On the results, Activision reported earnings per share of $0.38 versus BMO’s estimate of $0.72. Total net bookings were also down roughly 28% from last year and missed estimates by almost 20%. While monthly active users also took a steep hit, declining 15% year over year.

Additionally, the company saw its Blizzard bookings drop 43% year over year to $274 million, while BMO attributes this year over year loss to elevated covid engagement. They believe that the amount of new content will help to bring Blizzard bookings up in the second half of 2022.

Seemingly the only positive news that came out of the earnings report was that King’s revenue grew 12% to $682 million, while in-game bookings increased double-digit percentage points year over year.

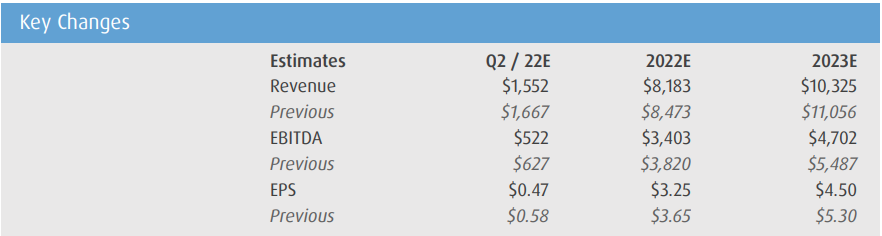

Below you can see BMO’s updated 2022 and 2023 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.