On Friday, Air Canada (TSX: AC) announced that they had agreed to terminate their acquisition of Transat A.T. The company originally announced the acquisition back in June of 2019, after which the two companies amended the terms twice, once in August 2019 and October 2020. As of Friday, they will now not go through with the transaction.

Canada’s Transport Minister, alongside the Europeans Antitrust chief, made comments on Friday related to the news. Canada’s Transport Minister confirmed that they are in talks with Transat to provide them with support as they might not be able to honour their obligations, while saying they “will not leave Transat without support.” The European Antitrust chief says that Air Canada offered “insufficient concessions to address concerns about the Transat takeover,” and that the deal would raise “competition concerns on large numbers of transatlantic routes.”

It seems analysts are still working out the impact of the defunct acquisition as none of the 18 analysts have changed their 12-month price targets or recommendations after the news. Although, announcing this on Good Friday is probably playing a partial role in this.

Air Canada currently has 18 analysts covering the company with a weighted 12-month price target of C$28.03. This is slightly up from the average from last month, which was C$27.81. Six analysts have strong buys while another eight analysts have buy ratings. Four analysts have a hold rating. The street high comes from Veritas with a C$33 price target, while Cormark has the lowest at C$24.

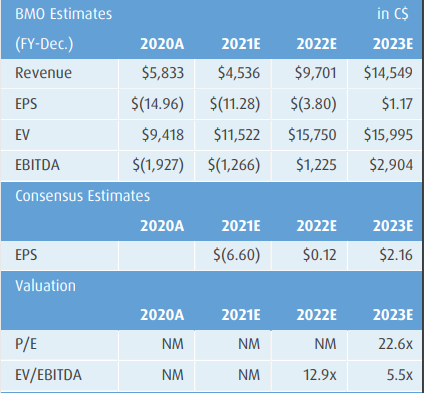

In a BMO Capital Markets note, sent out on April 4th. Fadi Chamoun reiterates their outperform rating and C$33 price target on Air Canada while saying, “AC’s dominant position in the Canadian air travel market remains solid. We continue to believe that the pandemic has allowed AC to structurally lower its costs and that should position the company to be a stronger competitor post-pandemic.”

Chamoun says that this acquisition would have been “good to have,” but the breakup is not investment altering. He believes that the Air Transat brand would have helped Air Canada’s market share in the leisure market while providing “fleet-related synergies, among other positives,” but other than that, Chamoun gives no other positives to the deal. Interestingly, Chamoun doesn’t make any changes to his estimates.

BMO Capital Markets is expecting another pseudo-Government bailout in the form of a “support package,” which includes low-interest loans among other things. Chamoun also anticipates that 2021 will be another year of high cash burn but expects Air Canada to “exit the year with strong demand momentum.”

They expect cash burn to be $3.2 billion in 2021 but will gradually get back to even cash flow by the second half of 2022. Chamoun writes, ” we believe that we are on a firm trajectory toward increased vaccinations with a reopening of nonessential services and returning population mobility by fall 2021.”

Below you can see BMO’s current estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.