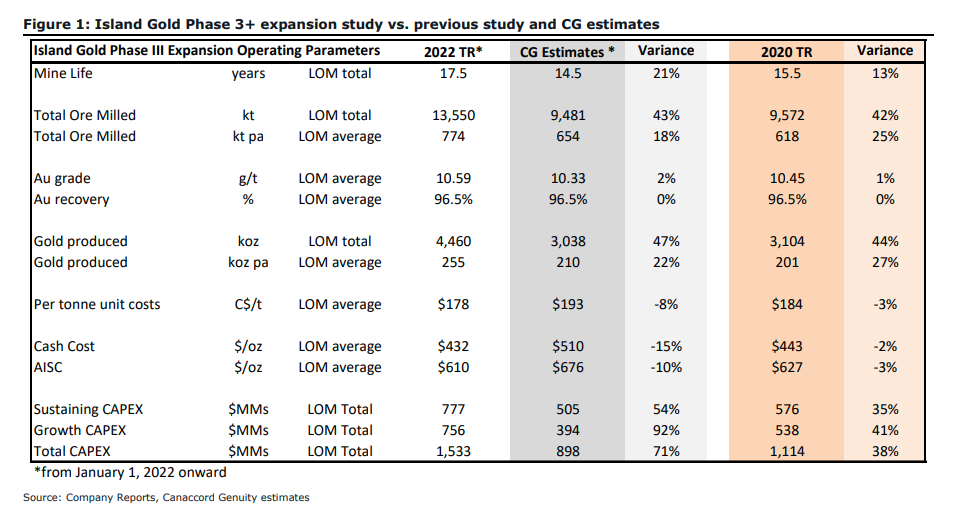

Alamos Gold Inc. (TSX: AGI) announced their phase 3+ expansion study of Island Gold located in Ontario, Canada this past week. The study showcased average annual gold production of 287,000 ounces starting in 2026, which is a 22% increase from the phase 3 study.

The Phase 3+ study estimates that the mine following the expansion will see average total cash costs of $432 per ounce, and all-in sustaining costs of $610 per ounce. The mine, following the expansion, is expected to have a mine life of 18 years and mineable resources of 4.6 million ounces of gold grading 10.59 grams per tonne.

Lastly, the company says that the phase 3+ study suggests that growth capital will be $756 million, and sustaining capital will be $777 million. While the after-net net present value of the mine is $1.6 billion and the after-tax internal rate of return is 23%, up from 20%.

Alamos Gold currently has 12 analysts covering the stock with an average 12-month price target of C$13.54, or an upside of 45%. Out of the 12 analysts, 2 have strong buy ratings, 7 have buy ratings, 2 have hold ratings and 1 analyst has a sell rating on Alamos Gold’s stock. The street high price target sits at C$18.25 which represents an upside of almost 100%.

In Canaccord Genuity’s note on the news, they reiterate their buy rating and increase their 12-month price target from C$12 to C$13, saying that Phase 3+ presents “a robust expansion scenario.”

Canaccord adds that this update “presents a more economically compelling project than the original proposal.” The post-expansion mine is now expected to deliver higher production over a longer period, with “no real change in operating costs”

Additionally, Canaccord is not surprised by the CAPEX increase, due to the larger project scope and general inflationary environment and suggests that the estimate appears to “have the lower embedded risk of escalation, given the major earthworks are substantially completed and 50% of the shaft infrastructure has been contracted out.”

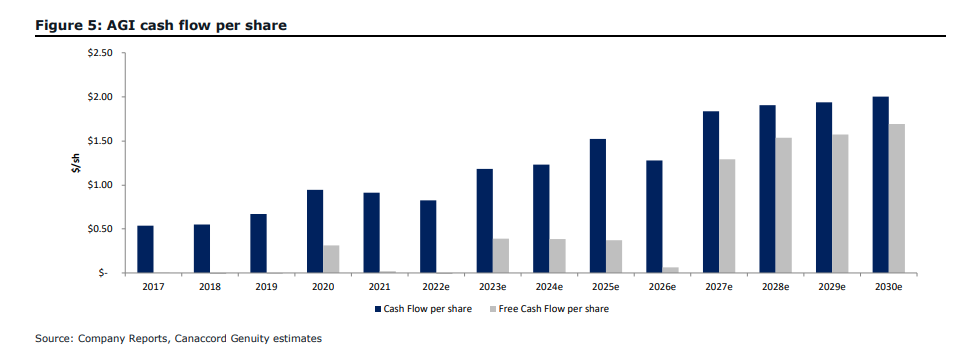

They also note that Alamos can afford to fund this project fully with its own balance sheet and operating cash flows even after factoring in the potential construction costs for its Lynn Lake project.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.