Alamos Gold (TSX: AGI) has completed an internal economic study that is set to extend the mine life of its Lynn Lake project in Manitoba to a total of 27 years.

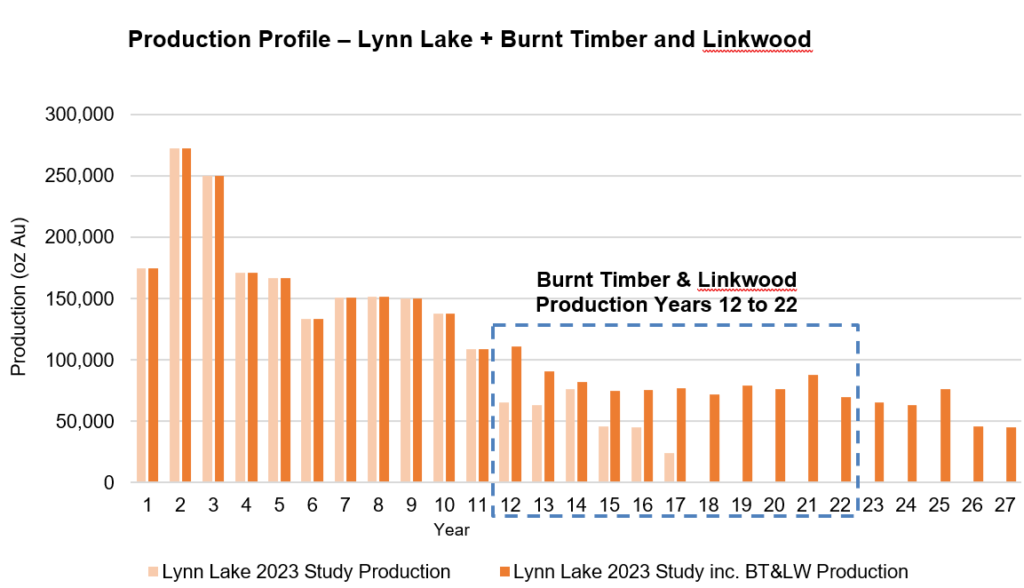

The study was conducted on satellite deposits to the project, referred to as Burnt Timber and Linkwood, which is to be viewed in combination with an updated feasibility study released in 2023 that outlined a 17 year mine life for the project. The new study focused on Burnt Timber and Linkwood being sources of additional mill feed beginning in year 12, after the higher grade Gordon and MacLellan deposits have seen their gold extracted.

The study outlines annual gold production of 83,000 ounces during the ten year mine life of the Burnt Timber and Linkwood deposits. The proposed extension comes with a net present value of $177 million and an IRR of 54%, based on a gold price of $2,200 and a discount rate of 5%. The NPV grows to $317 million if you discount the project to the start of construction. At $2,800 per ounce gold, those figures just to $292 million and $524 million, respectively.

Total cash costs are expected to come in at just $1,140 per ounce, while mine-site all in sustaining costs are pegged at $1,164 per ounce. When combined with the initial capital outlay of $67 million, total all in costs including mine life capital come out to just $1,241 an ounce.

Lakewood and Burnt Timber on a combined basis contain reserves of 940,000 tonnes of gold at 0.95 g/t. When combined with the other deposits, Lynn Lake as a whole has mineral reserves of 2.3 million ounces.

“The addition of Burnt Timber and Linkwood has enhanced the overall project and already strong economics by leveraging existing infrastructure to extend the mine life, and increase longer term production rates, at a low capital cost. The high returns within the Burnt Timber and Linkwood study highlight the significant upside potential across the larger, underexplored Lynn Lake greenstone belt,” commented John McCluskey, CEO of Alamos Gold.

Alamos Gold last traded at $32.70 on the TSX.

Information for this story was found via the sources and the companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.