Alphabet Inc (NASDAQ: GOOGL) reported its Q3 2022 financials on Tuesday, highlighted by a quarterly revenue of US$69.09 billion. This is a marginal decline from Q2 2022’s US$69.69 billion but an increase from Q3 2021’s US$65.12 billion.

The topline figure also missed the street estimate of US$70.7 billion quarterly revenue.

“We’re sharpening our focus on a clear set of product and business priorities,” said CEO Sundar Pichai in a statement. “We are focused on both investing responsibly for the long term and being responsive to the economic environment.”

CFO Ruth Porat added that “financial results for the third quarter reflect healthy fundamental growth in Search and momentum in Cloud, while affected by foreign exchange.”

Breaking down the revenue figure, all segments recorded a sequential decline except Google Cloud:

| Segment | Q3 2022 | Q2 2022 | Q3 2021 |

| Google Search & other | US$39.5 billion | US$40.7 billion | US$37.9 billion |

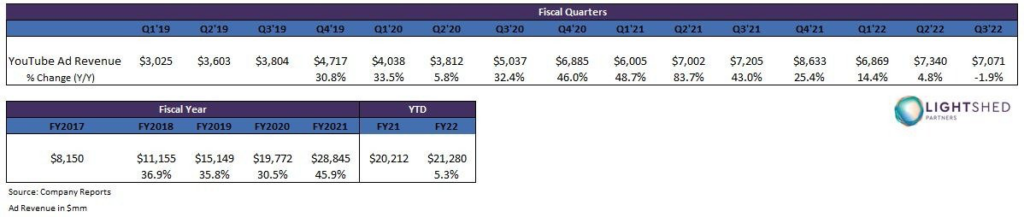

| Youtube ads | US$7.1 billion | US$7.3 billion | US$7.2 billion |

| Google Network | US$7.9 billion | US$8.3 billion | US$8.0 billion |

| Google other | US$6.9 billion | US$6.6 billion | US$6.8 billion |

| Google Cloud | US$6.9 billion | US$6.3 billion | US$5.0 billion |

| Employees | 186,779 | 174,014 | 150,028 |

The quarter also marks the first year-on-year decline for Youtube ads, falling 1.9% from last year’s counterpart.

“In Search and other ads revenues, while lapping the outsized performance was the largest factor in Q3, we did see some advertiser pull back in certain areas in search ads,” said Chief Business Officer Philipp Schindler in the earnings call. “And I think the example I called out was in financial services, in the areas of insurance, loan, mortgage, crypto subcategories. And we also noted a pullback in spend by some advertisers on YouTube and Network.”

This makes so much more sense now.$GOOGL Youtube revenue -2% year-on-year. https://t.co/WrKtPyvs8N

— Heikki Keskiväli (@hkeskiva) October 26, 2022

The firm also saw its workforce size grew to 186,779 employees from last quarter’s 174,014 and last year’s 150,028. This is a 24.5% increase year-on-year compared to the 6% annual increase in revenue (11% on constant currency).

“We’ve been clear that we are going to moderate our pace of hiring going into Q4 as well as 2023,” explained Pichai in the earnings call. “I think we are seeing a lot of opportunities across a whole set of areas. And every time, talent is the most precious resource, so we are constantly working to make sure everyone we’ve brought in is working on the most important things as a company and particularly so. And that’s a lot of what sharpening our focus has been about.”

Further down, operating income further slid down to US$17.14 billion from last quarter’s US$19.45 billion and last year’s US$21.03 billion. This further led to a decline in net income, with Q3 2022 ending at US$13.91 billion from Q2 2022’s US$16.00 billion and Q3 2021’s US$18.94 billion.

The bottomline figure translated to US$1.06 earnings per diluted share, missing the estimate of US$1.25 earnings per share.

Following the financials release, Alphabet’s shares fell by 6% in pre-market trading.

“As we head into 2023, we are going to focus on our most important priorities as a company. To support our growth, we’ll continue to invest responsibly for the long term in a way that is responsive to the current economic environment,” added Pichai.

The company early on this month pulled its Google Translate services in mainland China, which was one of its last few remaining services available in the country known for its sweeping censorship rules.

Alphabet’s Google is also facing a political discrimination lawsuit filed by the Republican National Committee, saying that it is unable to contact party members in order to raise funds because the internet giant is directing email messages to spam folders.

Information for this briefing was found via Seeking Alpha and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.