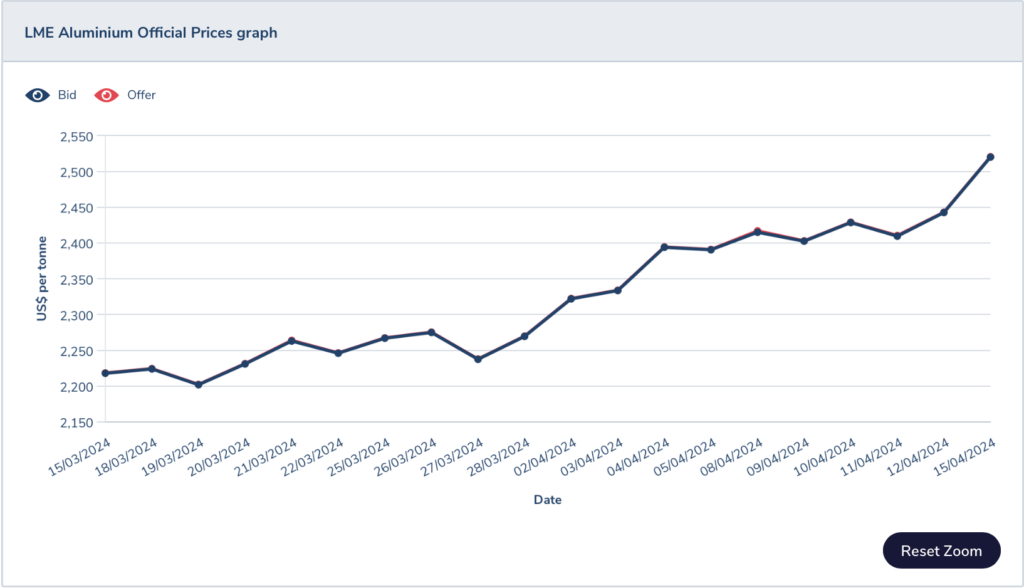

In response to the imposition of new sanctions by the United States and the United Kingdom, aluminum and nickel prices surged on the London Metal Exchange (LME). The sanctions, which came into effect after midnight on Friday, ban deliveries of any Russia-sourced metal through the exchange that has been produced after April 13, 2024.

These fresh restrictions, aimed at undermining President Vladimir Putin’s capacity to finance his military operations, have injected significant uncertainties into the metals markets. This move follows the backdrop of Russia’s invasion of Ukraine, which has already reshaped the dynamics of these markets.

Aluminum witnessed a spike of up to 9.4%, marking the most significant increase since the inception of the current contract in 1987, while nickel rose by as much as 8.8%.

Jia Zheng, the head of trading and research at Shanghai Dongwu Jiuying Investment Management Co., noted that the rally stems from concerns that the sanctions will curtail Russian flows to Western markets.

“Any stimulation will be amplified amid an existing bullish backdrop,” said Jia.

However, there are also apprehensions regarding the possibility of an influx of old Russian metal, which is still permissible under the sanctions, flooding the LME. Market participants, including dealers and brokers, have been actively assessing the implications of the sanctions over the weekend.

The timing of the sanctions, just before the global copper industry’s annual CESCO Week gathering in Chile, has fueled discussions within the industry, with many traders closely monitoring developments late into Sunday night in London.

Despite the significant impact of the sanctions, traders and executives suggest that the restrictions are unlikely to have as dramatic an effect as previous events, such as the nickel short squeeze in March 2022 or the sanctions on United Co Rusal International PJSC in 2018.

Although Russia’s major metal giants, Rusal and MMC Norilsk Nickel PJSC, are less intertwined with the Western financial system compared to before the conflict, Russia remains a vital producer, accounting for 6% of global nickel supply, 5% of aluminum and 4% of copper.

The LME has implemented daily limits to curb excessive price fluctuations since the nickel squeeze, with further volatility anticipated due to escalating hostilities in the Middle East.

The sanctions categorize the market into three segments: new Russian metal, old Russian metal produced before April 13, and non-Russian metal. The LME confirmed that “old” Russian metal can still be delivered, subject to approval on a case-by-case basis.

However, the LME’s approach has reignited a debate over whether Russian metal should be entirely banned to safeguard the exchange’s role as the global benchmark for metal prices.

With Russian metal already comprising 91% of LME aluminum stocks at the end of March, 62% of copper, and 36% of nickel, traders anticipate a potential influx of Russian material onto the exchange, further impacting prices.

Russian metal accounts for 91% of LME aluminum stocks, 62% of copper and 36% of nickel. https://t.co/pL5AHyBalT pic.twitter.com/Xi3fUmI70L

— Tracy (𝒞𝒽𝒾 ) (@chigrl) April 15, 2024

While the LME considered banning Russian metal in 2022 and decided against it, it continues to review its position in light of evolving circumstances. Additionally, the new rules introduced on Friday ease restrictions on traders seeking delivery of old Russian metal from the LME.

Information for this story was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.