Amazon.com, Inc. (Nasdaq: AMZN) last week reported its third-quarter financial results. The company continued the tech-trend of worse-than-anticipated results, reporting revenues of $127.1 billion, up 15% year over year. North American segment sales increased by 20% to $78.8 billion, and AWS saw its sale increase by 27% to $20.5 billion.

Increases to the company’s top-line revenue did not trickle down to its operating income, which decreased to $2.5 billion from $4.9 billion a year ago. The company’s North American operating segment saw a net loss of $0.4 billion, down from an operating profit of $0.9 billion a year ago. However, their AWS segment saw their operating income rise to $5.4 billion from $4.9 billion a year ago.

Net income for the quarter came in at $2.9 billion or earnings per share of $0.28, down from $3.2 billion or $0.31, respectively. Operating cash flow also took a hit, decreasing 27% to $39.7 billion for the trailing twelve months. Amazon’s free cash flow for the twelve-month trailing was an outflow of $19.7 billion, compared to an inflow of $2.6 billion last year.

Amazon also provided guidance for its fourth-quarter results. The company now expects net sales to be between $140 and $148 billion for the final quarter of the year, while it expects operating income to be between $0 and $4 billion.

After the earnings, several analysts lowered their 12-month price target on Amazon, bringing the average 12-month price target down to $146.35 from $171.32 a month ago. Out of the 52 analysts, 17 continue to have a strong buy rating on the stock, and 31 analysts have buy ratings. Meanwhile, three analysts have hold ratings on the stock, and a single analyst has a sell rating. The street-high price target sits at $232.75.

In Canaccord Capital Markets’ note on the results, they reiterate their buy rating on the stock. Still, they slash their 12-month price target to $160 from $200, saying that the macro backdrop, inflation, and rising energy prices are all expected to continue to impact consumers’ purchasing power worldwide.

Canaccord comments that Amazon shares are down almost 50% from their all-time high and “while near-term results are likely to remain pressured by a challenging operating environment.” They believe this represents an “attractive” entry point for long-term investors.

On the results, Canaccord says that total revenues came in line with guidance but slightly below their estimate. They add that the eCommerce revenues “enjoyed” a 4% boost from Prime day, while the company also lapped “a more normalized comp.”

Subscription revenue grew 14% year over year; the growth was mainly attributable to the launch of Lord of the Rings: Rings of Power, which attracted more Prime sign-ups globally than any other Amazon original, while Thursday Night Football saw more than 15 million viewers for its debut game.

Amazon Web Service revenue came in slightly below consensus, while growth dropped below 30% for the first time in seven quarters. Management noted that customers “were increasingly focused on controlling costs.”

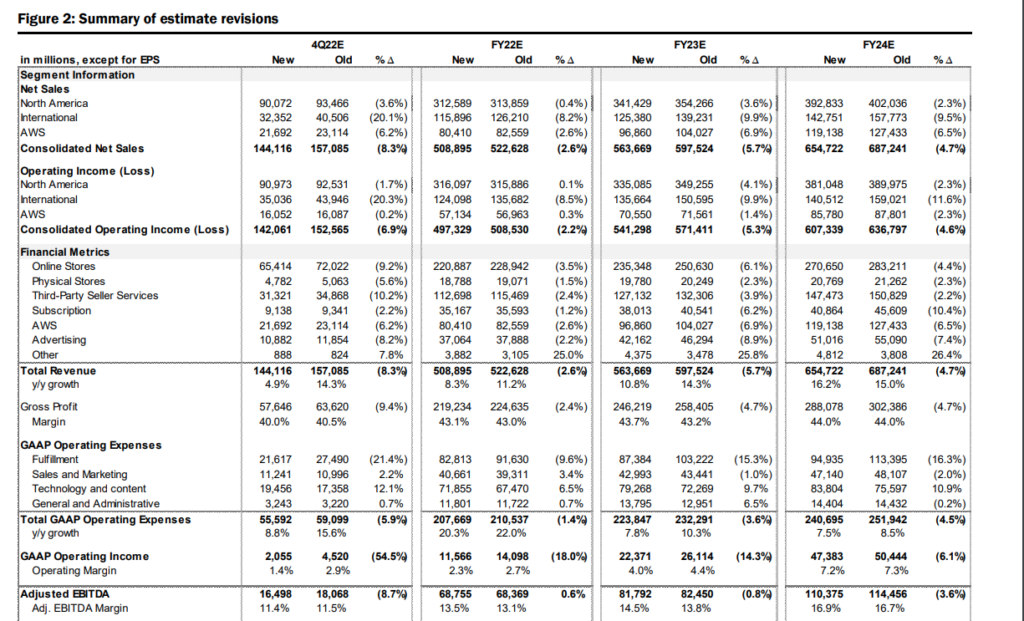

Canaccord lowered their estimates on Amazon to reflect “ongoing FX headwinds and easing consumer demand in the face of macroeconomic uncertainty and inflation.” Below you can see Canaccord’s updated estimates.

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.