Amazon.com, Inc. (Nasdaq: AMZN) announced that its board approved on Wednesday a 20-for-1 split for the firm’s common stock. The tech giant also authorized a US$10 billion share buyback program.

Following the announcement, the company’s shares jumped by 5% post-closing bell, even reaching back to its US$3,000-mark.

The company last traded at US$2,785.58 on Nasdaq, which post-split will give shareholders 19 more shares valued at US$139.28 each.

If you can’t understand why some investors think a $140 stock is cheaper than a $2700 stock… a Dollarama visit would blow your mind https://t.co/wWIhHrPsmd

— Deirdre Bosa (@dee_bosa) March 9, 2022

Why is Amazon doing a split? The company did not provide specific reasons. Stock splits are usually textbook measures for a company to enhance liquidity and make the shares more retail-friendly due to lower costs.

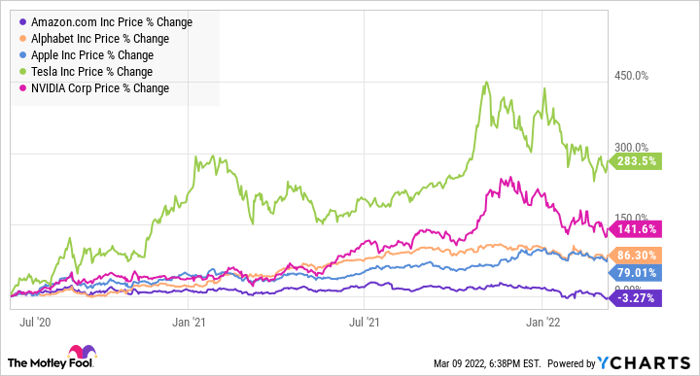

But given the momentary rally for the share price after the stock split was announced, Amazon stands to gain in improving its share performance. The company’s stock was the worst performer in 2021 among the big tech and has seen meager improvements even during a surge in online transactions during the pandemic.

The last time Amazon did a stock split was in September 1999, a 2-for-1 ratio. The stock price prior to the split was at US$120.13, and while the valuation improved thereafter, this was hampered by the tech bubble burst. Two years after the stock split, the shares were trading below the US$10.00 mark.

Alphabet (Nasdaq: GOOG) also announced a 20-for-1 stock split in February 2022, which saw its shares rise by 9% following the announcement.

Why is $AMZN ripping after a stock split?

— SmallCapSteve (@smallcapsteve) March 10, 2022

Reached into my promoter playbook to recall when the Deslaurier Twins did a forward split on a stock from 49M shares at 7.5c to 149M shares at 1.5c

Stock ripped to $3.19 by the split date.

Became Cannabis Wheaton, then Auxly $XLY pic.twitter.com/wXXuoQP13H

On the other hand, the US$10-billion share buyback program is the company’s first one since 2016. Then, the company was authorized to repurchase up to US$5 billion shares and was able to buy back US$2.12 billion upon the closing of the program.

The stock split is expected to take effect on June 3, 2022, and the trading of the expanded shares will start on June 6, 2022.

$AMZN 20-1 stock split pic.twitter.com/7nyTdn7G1m

— Dividend Hero🍀 (@HeroDividend) March 9, 2022

Information for this briefing was found via Edgar, CNBC, and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.