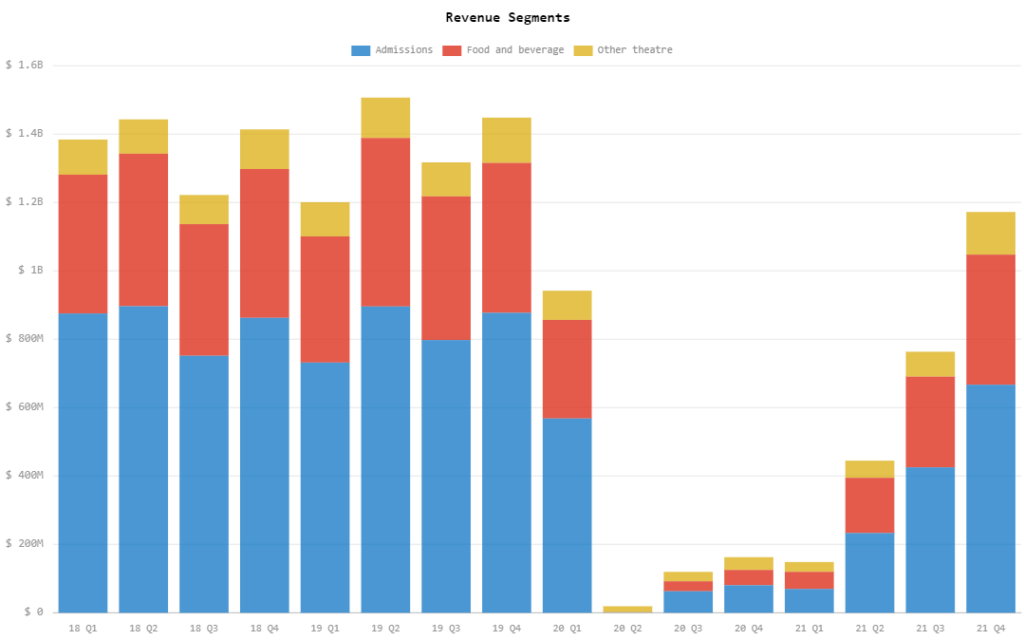

AMC Entertainment Holdings, Inc. (NYSE: AMC) reported on Tuesday its financial results for Q4 and full-year 2021. The quarterly revenue, as preliminary reported by the firm, came in at US$1.17 billion in revenue, an increase from Q4 2020’s revenue of US$162.5 million.

Breaking the quarterly revenue figure, admissions contributed US$666.6 million, food and beverage contributed US$380.5 million, and other theatre revenue added US$124.6 million.

However, the firm still incurred operating expenses higher than its revenue, leading to an operating loss of US$60.4 million. This compares to the operating loss of US$969.6 million incurred in the year-ago period.

This further led the firm to record a quarterly net loss of US$134.4 million, a huge jump from last year’s US$946.1 million net loss. This translates to US$0.26 loss per diluted share.

Calibrating for financial items, adjusted EBITDA for the quarter came in at US$159.2 million, the firm’s first quarterly positive EBITDA in two years, and exceeds the expected range of US$146.8 – US$151.8 million. This compares to last year’s EBITDA loss of US$327.5 million.

In the company’s earnings call, CEO Adam Aron asserted that “AMC seems to be on a positive glide path to recovery.”

“There is so much conventional wisdom floating around that movie theaters cannot coexist and cannot thrive in a world of streaming. What a load of cow dung there,” Aron said.

Aron supported this by bringing up the reports floating in 2020 that AMC would file for bankruptcy and experts predicting the share price will fall to US$2.00 by Q1 2022.

“[Those] experts gravely underestimated AMC. And with the full benefit of hindsight, we can now happily say because now it’s a simple matter of fact, they were wrong. They were wrong,” he added.

The chief executive also acknowledged once more the firm’s “enthusiastic and avid shareholder base.” In his estimates, the theater chain was able to keep the same number of individual shareholders compared to a year ago, “in the neighborhood of 4 million individual investors,”

“If you exclude index funds [that] have no choice but to own and hold AMC shares, individual retail investors would seem to own more than 90% of our officially issued 516 million shares as of today,” said AMC’s chief.

$amc 10% of amc shares is 51,322,000 shares, divided over 4,000,000 is about 13 shares. Hmmmmmmm so you are telling me… if tomorrow, each retail investor bought 13 shares for $242, we would become officially 💯 owners of amc 🤔 interesting #AMCSqueeze #AMCtothemoon

— Storm (@KMourks) March 2, 2022

How does one push the stock price down from $60 to $18 with 10% of the shares. Asking for a friend. $AMC #AMC

— Bill Bugsy (@bill_bugsy) March 2, 2022

It is unclear if the company will still continue holding back on equity issuance but Aron reassured the shareholders in the call that the firm will “keep [its] word.”

“Some of you then speculated that we would rush to immediately issue new shares to the public early in January as the new year started. It is already March. Again, we have not done so,” Aron added.

90. PERCENT.

— Trey’s Trades (@TradesTrey) March 1, 2022

In February 2022, Aron tweeted his intention to donate US$1.0 million worth of shares to charity.

AMC Entertainment last traded at US$18.32 on the NYSE.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.